Investment Market Update: Q3 2017

If you would have told us in June that after all of the headline-grabbing events over the last three months—failure to pass healthcare reform, hurricane after hurricane after hurricane, saber-rattling by the North Korean dictator (and POTUS) —that equity markets would have quietly marched higher, we would have told you, “You’re bananas.” But here we are, and that’s exactly what has happened.

The Dow and the S&P 500, the most widely-quoted US market indices, posted their first eight-quarter (that’s two whole years) win streak in twenty years. It’s an amazing feat given the market volatility we experienced in 2015 and the beginning of 2016. As we write this, the Dow the S&P 500 and the NASDAQ, continue to hit fresh new all-time highs.

A breakdown shows that just about every asset class gained at least modestly in value these last three months. The S&P 500 increased 4% for the quarter and is up 12.5% so far in calendar 2017. Smaller company stocks, as measured by the Wilshire US Small-Cap index, posted a 5.4% gain over the third three months of the year, and are up 9.5% for 2017 so far.

As nice as the returns have been domestically, international stocks this year have been even kinder to your investment portfolios. The broad-based EAFE index of companies in developed foreign economies gained 5.5% in the recent quarter and is now up a very healthy 20.4% for the first nine months of this year. Emerging market stocks of less developed countries, as represented by the EAFE EM index, rose 7.0% in the third quarter, sitting with a remarkable 25.4% gain for the year so far. Truth be told, we’ve been high-fiving ourselves a little bit over these foreign stock returns, because it was only a year or so ago that some concerned clients were asking why we insisted on keeping these losers, and why we weren’t even more concentrated on US stocks than we already were. We told them every dog has his day, and that patience is a virtue. This year, that patience is paying off handsomely for you.

Looking over the other investment categories, real estate, as measured by the Wilshire U.S. REIT index, posted a meager 0.6% gain during the year’s third quarter, and is now up 2.4% for the year so far. Gold prices were also up about 3.1% over the last three months, and 11.1% for the year.

In the bond markets, you know the story: rates on 10-year Treasury bonds have ticked up from 2.30% at this point three months ago to a roaring (haha) 2.33%, while 30-year Treasury yields have also risen modestly from 2.83% to 2.86%.

One might imagine that the concerns about the new president, changes in government policy and uncertainty around fundamental economic issues (failed attempts to repeal the Affordable Care Act and delays in rewriting the tax code, for example) would spook investors, and if those weren’t scary enough, there are those nuclear threats and name calling being lobbed back and forth between Pyongyang and Washington. Hurricanes have disrupted economic activity in Houston and large swaths of Florida, while Puerto Rico, the U.S. Virgin Islands and much of the Caribbean lie in ruins. Despite all those headwinds, the bull market sails on unperturbed. Amazing.

How can this be? If you’re thinking corporate profits, you get a gold star! When you look past the headlines, the underlying fundamentals of our economy are still remarkably solid, even this deep into our long, slow economic expansion. Corporations reported better-than-expected second quarter earnings, with adjusted pre-tax profits reaching an annualized $2.12 trillion—which means that American business is still on sound footing. Unemployment continues to trend slowly downward and wages even more slowly upward. The economy as a whole grew at a 3.1% annualized rate in the second quarter, which is at least a percentage point higher than the recent averages and marks the fastest quarterly growth in two years. There is hope that a new tax package will be coming out of Congress that will prove to be as business-friendly as the Trump Administration has been promising.

Economists tell us that the multiple whacks of hurricane damage will slow down economic growth figures for the third quarter, although the building boom fueled by the destruction will likely mitigate that somewhat. There are no economic indicators that would signal a recession on the near horizon, and one of the potential panic triggers—a Federal Reserve Board decision to recklessly raise interest rates—seems unlikely given the Fed’s extremely cautious approach so far.

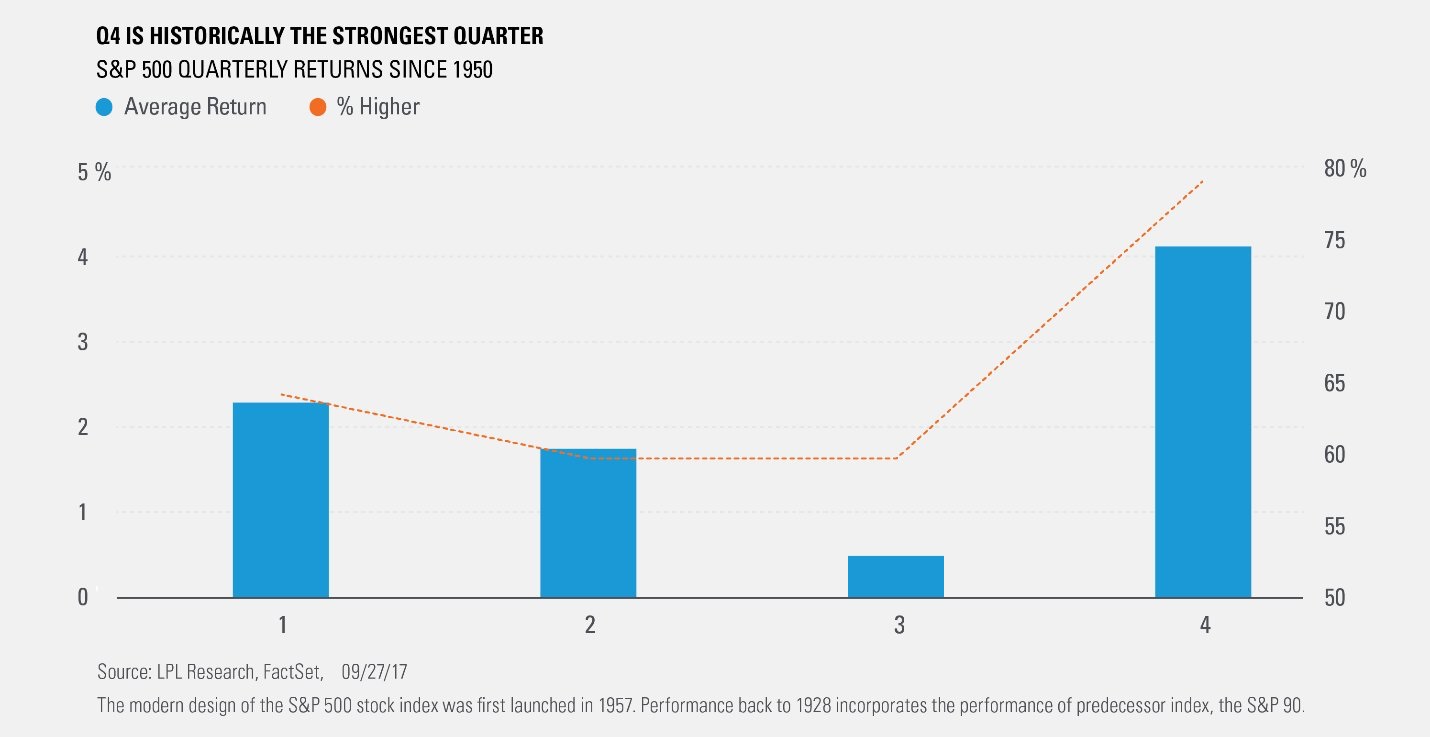

Meanwhile, as you can see from the accompanying chart, fourth quarters have historically been kind to investors—much kinder than third quarters.

There are still potential speed-bumps ahead. The Trump Administration has threatened multiple trade wars with America’s major trading partners – NAFTA members Canada and Mexico, and China. Tighter immigration rules could lead to even tighter labor supplies and spike inflation. The tax-reform debate is just getting started. If investors believe economic and fiscal policy change(s) may hamper the economic recovery, those changes could add to short-term market volatility. Who can say? What we do know is that in the long run stock prices follow corporate profits, and corporate profits, around the globe, have been rising. We continue to keep an eye on things for you and will take any steps that become necessary.

As always, we appreciate your confidence and welcome questions about your portfolio or overall financial life.

Lastly, the holidays are right around the corner. We hope you are looking forward to sharing them with loved ones, just as we are!

Are you looking for life-long financial planning support beyond traditional wealth management? Then Del Monte Group is the right place for you. At DMG, we address a client’s entire lifestyle to help make all goals become a reality–even if they aren’t directly related to money. Our clients are more than just assets and investments. They are human beings with their own stories, and they are our family. So, when you’re in the greater Alamo or Danville, California area our door is always open to assist you in person Call us at 925.736.6410, send an email to Info@APlaceOfPossibility.com, visit APlaceOfPossibility.com/Calendar to get your meeting on the books. We can't wait to help you.