By: Chris Hughes, CFP®

Want to make a sizable donation to your favorite charity, or help a child out with a gift? Did you know that you could be missing out on significant tax savings when you gift using cash or checks? We’re going to let you in on three great gifting strategies that are practically secrets, since surprisingly few people use them.

Each of these three strategies involves the gifting of appreciated assets instead of those checks or cash. This article will show you how you can leverage your gifts by reducing your income tax burden even further than you thought possible.

LEVER ONE: DONATING APPRECIATED ASSETS

First, let’s define “appreciated assets.” You might also hear them called appreciated investments or appreciated securities. We’re going to use these terms interchangeably, but what we mean is a publicly traded stock, bond, Exchange Traded Fund (ETF), mutual fund shares, real estate and closely held stock. Giving to one’s church or favorite charity in and of itself is a personally rewarding experience. If you are currently writing checks or making cash donations to your church or favorite charity, but you also have appreciated investments, you are also missing out on significant cost-free tax-savings opportunity.

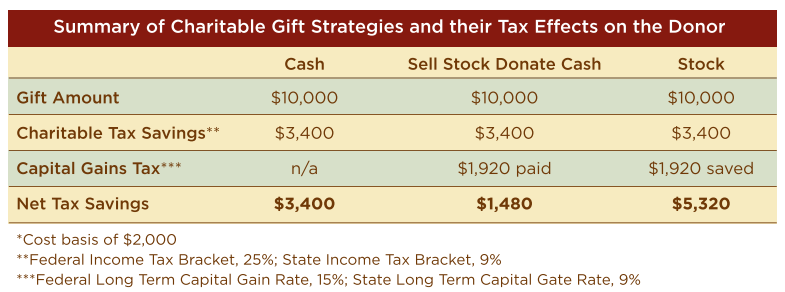

For example, suppose that Tom Jones would like to donate $10,000 to his favorite charity. Let’s compare three options Tom has for making the donation: (1) cash or check; (2) sell appreciated assets and use the proceeds to make the donation; (3) donate the appreciated asset directly to the charity.

Option 1: Making a charitable donation by cash or check is pretty straightforward. You receive a charitable tax deduction based on the amount given (subject to some income limits and other fun tax laws).

Option 2: If Tom sells assets that have appreciated in value and uses the proceeds for the intended donation, he will have to pay federal and state (if applicable) capital gains tax on the realized gain on the sale of the asset sold. The capital gains taxes paid can be at the higher short-term gains tax rate, or at a lower long-term depending on how long the security has been held. Of course, any taxes due eats into the remaining amount that can be gifted to his intended charity.

Option 3: If Tom chooses not to sell the appreciated asset but instead simply donates the actual shares directly to the charitable organization, he will have zero capital gains tax to pay. The full fair market value of the asset on the day of donation qualifies as a charitable deduction, so long as he has held the shares for more than one year, and the unrealized capital gains disappear from a tax perspective. The charity can sell the received shares without having to pay taxes on the unrealized gain because the charity is a tax-exempt entity. Option 3 is a win-win for all parties involved.

In the example above, Tom’s net tax savings for contributing appreciated securities is over 50% greater than a cash gift!

In the example above, Tom’s net tax savings for contributing appreciated securities is over 50% greater than a cash gift!

In the event one is donating a stock they would like to keep in their investment portfolio, the cash that originally would have been used to make a charitable donation in Option 1 can be used to buy back the stock for the donor. This will effectively give them a step up in cost basis on the shares they own. The IRS wash sale rules, which state that you cannot sell a stock and then buy it back within 30 days to increase your cost basis, do not apply because the donor never sold the stock. The charity did. As a result, the investor can repurchase the same number of shares without having to wait 30 days.

This charitable giving strategy is especially helpful for donors with concentrated stock positions from an employer or otherwise, that need diversification but want to avoid the tax hit. The strategy allows donors to gradually diversify their holdings in a highly leveraged and tax-efficient way.

Naturally, the IRS doesn’t want us having too much fun, so the deduction for these donations (along with all charitable gifts) is limited by the IRS, depending upon one’s adjusted gross income (AGI):

- Deduction for cash – up to 50% of Adjusted Gross Income (AGI)

- Deduction for appreciated assets – up to 30% of AGI

They do allow for a five-year carry forward of any unused charitable deductions.

Most churches and charities are now able to accept appreciated securities, and the transfer process is very simple. In fact, your financial advisor should be able to do the heavy lifting for you.

In the case your charity does not accept appreciated securities donations, see our next option, Donor-Advised Funds.

LEVER TWO: DONOR-ADVISED FUNDS

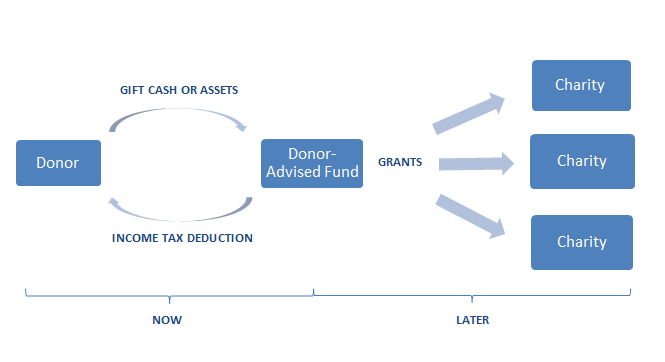

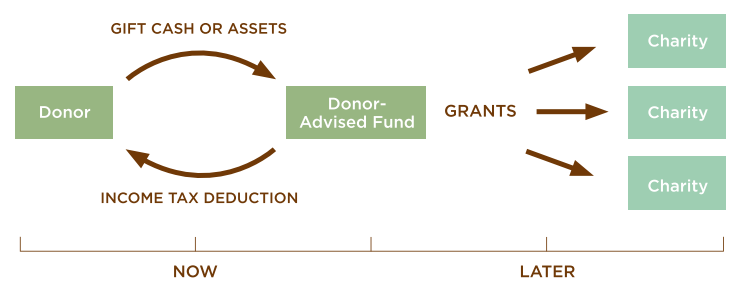

A second highly leveraged and tax-wise gifting strategy is to establish a Donor-Advised Fund (DAF), and donate appreciated securities to the DAF. This can be an efficient way to accomplish both philanthropic and tax goals.

A Donor-Advised Fund is a vehicle used to make charitable donations to a charitable investment account without having to make a grant to a particular charity today. This is possible because the DAF itself is the tax-exempt charity. Individuals receive a tax-deduction today equal to the fair market value of contributed cash or securities. Contributions to the DAF, including appreciated securities, can be invested in any investments offered by the DAF custodian. At a future time chosen by the donor, grants to specific charities can be made by check withdrawn directly from the DAF.

Donor-Advised Funds are not new; they were created during the 1930’s. However, it wasn’t until the 1990’s that they began to grow in popularity. These versatile, cost free accounts are offered by many financial institutions, including Charles Schwab, Vanguard, and Fidelity.

Donor-Advised Funds are not new; they were created during the 1930’s. However, it wasn’t until the 1990’s that they began to grow in popularity. These versatile, cost free accounts are offered by many financial institutions, including Charles Schwab, Vanguard, and Fidelity.

Beyond the immediate income tax deduction and the elimination of taxation on the embedded unrealized capital gains, funds contributed to DAFs are not subject to estate taxes and grow tax-free within the account. The tax-free growth ultimately means that donors may be able to leverage the initial contribution and make even larger donations to charity in the future without additional cash outlays. Ever wanted to have a hospital wing named after you? Donor Advised Funds can get you there, even if you can only contribute limited amounts each year, because of the tax-free growth of the DAF account values.

For those who are charitably inclined, Donor-Advised Funds can be a great planning tool, especially to reduce taxable income and maximize the value of charitable gifts during exceptionally high income/high tax years, by front-loading the contributions when you can get the maximum tax deduction, and then distributing them to your church or other charities over time during future lower years when you know you will have a lower income tax rate. DAFs can also be used to offset income taxation that would otherwise be due on Roth IRA conversions and to allow non-itemizers a one-time opportunity take advantage of itemized deductions. DAFs can also be utilized as a family legacy gifting vehicle or as a training ground for your heirs, teaching them how to work together as a team to manage the funds inside the DAF and how to collaboratively choose worthy charities to contribute to.

As previously discussed, the ideal assets to contribute to Donor-Advised Funds are highly appreciated securities held for more than one year, and individuals are offered the same tax benefits as discussed above–a tax deduction of the fair market value of the asset, and elimination of taxation on the embedded or unrealized capital gains on those assets.

Donor-Advised Funds can also be used to get around the problem of donating to those charities that are unable to directly accept gifts of appreciated investments. A way to have your cake and eat it too! Gotta love that!

LEVER THREE: GIFTS OF APPRECIATED ASSETS TO CHILDREN AND GRANDCHILDREN

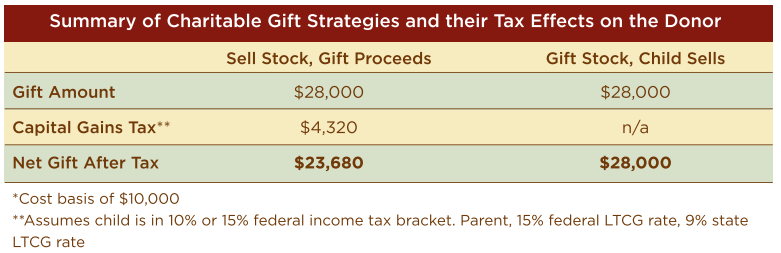

Leaving qualified charitable contributions and moving into the realm of contributing to charity cases that share our DNA, you can also use appreciated assets to make gifts to your children or grandchildren. Whether it is to help pay for college tuition, provide assistance with a down payment on a home, to reduce your estate taxes, or just financially help support a family member through a difficult period of life, consider replacing your cash gifts to them with gifts of appreciated securities. As with charitable donations, cash or check may well be the most convenient way to make a gift. However, donating shares of highly appreciated securities to the family member may be a more tax-efficient way to solve problems or transfer your wealth. A strategy of “income shifting” — shifting the burden of potentially paying a high capital gains tax on the sale of highly appreciated stock, to a family member whose capital gains tax rate would be much lower, or even zero – is an incredibly smart and efficient way to gift.

Before 2006, gifting highly appreciated securities was one of the go-to financial planning strategies to help children/grandchildren pay for college expenses. Parents were able to shift income to their children who were in a lower tax bracket. Instead of the parents selling the asset, realizing the capital gain at their tax rate, the child sells the asset, realizing the capital gain at their, presumably lower, tax rate. If they have very little or no income and find themselves in the bottom two federal income tax brackets, they may pay 0% in capital gains tax.

In 2006, Congress expanded the age where children are subject to their parent’s tax rate on their own investment income, from 14 years old to age 18, or 24 for full-time college students. This change has somewhat limited the ability to shift income to children, but in the right situations, tax savings opportunities still exist. A great example of where this strategy still works is when mom and dad are in a very high tax bracket and want to gift highly appreciated securities to their low-income 30 year-old daughter to buy her first home. When the daughter sells the assets, the capital gains tax will likely be very low, in effect allowing the extended family to reduce their overall tax burden, and since the daughter is buying a house, she’ll likely have some mortgage interest to deduct, possibly further reducing the tax bill on the sale of that asset.

Kiddie taxes can be avoided for younger children under age 18, but the only way is if the total investment income is below $2,100. The first $1,050 of such “unearned income” is not taxed, while the next $1,050 is taxed at the child’s tax rate. Unearned income above $2,100 is taxed at the parent’s tax rate, so careful attention to these rules can be beneficial, particularly if you have several children.

If the unearned income is above $2,100, the only way that college students under age 24 will be able to avoid the kiddie tax is if they provide over half of their own support from their own earned income (i.e., wages and salaries, not income from selling stocks). For those children age 24 and older or those over 18 and part-time college students, the kiddie tax does not apply.

For illustrative purposes, consider parents or grandparents who wish to support their family members financially. They could choose to liquidate assets themselves, paying capital gains taxes at their own tax rate, and use the net proceeds to fund the gift. Alternately, they could gift the appreciated securities directly to their children, who can, in turn, sell the asset to realize the cash.

Let’s take a look at these two scenarios: (1) parents sell asset, gift proceeds to child; (2) gift appreciated asset to child, child sells the stock.

In the example below, it is assumed that the family avoids the kiddie tax.

By shifting income to their child, the parents avoid paying any capital gains taxes on the gain. The child can avoid paying the tax altogether because she is not subject to the Kiddie Tax and has very little other taxable income. In a case like this, an adult child who is not subject to the Kiddie Tax and has little other taxable income could realize long term capital gains totaling $48,000 on gifted assets received from her parents and pay ZERO capital gains tax. Now THAT is some serious tax savings!

By shifting income to their child, the parents avoid paying any capital gains taxes on the gain. The child can avoid paying the tax altogether because she is not subject to the Kiddie Tax and has very little other taxable income. In a case like this, an adult child who is not subject to the Kiddie Tax and has little other taxable income could realize long term capital gains totaling $48,000 on gifted assets received from her parents and pay ZERO capital gains tax. Now THAT is some serious tax savings!

What is the right gifting strategy for you? Selecting the most appropriate strategies for your individual needs and objectives is a complex process that requires careful consideration. Consult with your financial advisor or tax advisor who can assist you in evaluating the tax advantages of gifting appreciated securities.

Please feel free to contact our team with questions!

“One-size-fits-all” won’t fit you here! The Del Monte Group team understands that everyone’s financial goals are unique. That’s why we always provide customized advice. No matter where you are in life, you can depend on our proven expertise to provide financial planning support for long-term success. Ready to get started? Schedule a meeting with Richard or Angela in our Alamo, CA based office today or we can meet via Zoom! >> You can select a date and time that works for you via our calendar, call us at 925.736.6410, or send an email to Info@APlaceOfPossibility.com. We can’t wait to help you!