The markets continue to be very choppy and volatile, sending shivers down the spines of investors around the world. Triple digit daily gains and losses in the Dow Jones Industrial Average (Dow) seem to be the rule in recent months, as is normal during periods of big change.

However, if we take a step back from the daily roller coaster ride, we see that the stock market has been trading roughly within the range of 8000 and 9000 on the Dow for over a month (actually since October 10th). Every time the market has gone above 9000, it has been smacked back down, and every time it has gone below 8000, it has exploded upward. So, despite the daily violent swings, the market really hasn’t been going anywhere for quite a while.

Another way to look at it is the market has traded around 8500, give or take a few hundred points. For a lot of people, seeing recent market action in this light helps take a lot of their fears away.

So, where are we now and where is all this headed? Here’s what the Wall Street Journal (WSJ) reported last Friday:

“The U.S. economy is in the midst of the worst part of the recession, but growth may return by the second half of next year, according to economists in the latest Wall Street Journal forecasting survey.

On average the 54 economists surveyed expect gross domestic product to decline 3% at an annualized rate in this year's fourth quarter. That comes after the Commerce Department reported a 0.3% drop in the third quarter. Another negative reading is forecast for the first three months of next year with an essentially flat reading for the second quarter. Slow growth is seen for the second half of 2009, reaching 2.1% by the fourth quarter.

“By the third quarter of next year a recovery will be under way,” said John Lonski of Moody's Investors Service, but he added that expansion won't return to pre-crisis levels until 2010.”

And here’s what the National Association of Business Economists’ poll of 50 professional forecasters said today:

“…Real gross domestic product was expected to fall 2.6 percent in the fourth quarter and slump 1.3 percent in the first three months of 2009.

More than a third reckoned the recession began in the third quarter of 2008, and nearly three-quarters believed it could persist beyond the first quarter of 2009. Over 60 percent expected the depth of the recession to be contained, with the decline in GDP bottoming below 1.5 percent. The unemployment rate was likely to peak at 7.5 percent by the third quarter of 2009.”

Today, the Federal Reserve said today that industrial production in the US jumped 1.3% in October, compared with the month before.

The WSJ forecasting survey and NABE poll begin to sketch a possible outline of how things might go. Here’s how it looks to us at this point:

- We are in the middle of what will likely turn out to be the worst quarter of the current recession. We’ll probably see 2.6 to 3% declines in gross domestic product (GDP) in the fourth quarter.

- The first quarter of next year will likely be a little better, but will still show some contraction in the economy. The second quarter of 2009 will probably show flat economic growth, followed by a recovery beginning in the third quarter.

- Unemployment will peak around 7.5% to 7.7% later next year. Note that unemployment rates typically peak after the economy has already begun recovering. This is because employers usually have much better hindsight than foresight, and tend to be more reactive than proactive.

- If the economists' average forecast were to materialize, the depth of the downturn would be about on par with the 1990 recession, but it wouldn't reach the low levels seen in the early 1970s or 1980s.

So, how does this information square with everything you have gleaned from your own newspaper reading and TV news watching? Yeah, that’s what I thought. They’re still predicting Armageddon and another Depression, right. Oh, and that market bottom is, according to them, still a LONG way away. That’s what they no doubt hope for, as it keeps everyone reading, watching and listening, like deer in the headlights.

Things could still get worse than everyone expects. One factor that REALLY matters is how consumers behave in the next few weeks and months. If we all panic and stop spending money completely, it will probably be worse. Ironically, the best thing we can all do is go shopping–the sooner the better. Tell your friends to go shopping with you. Organize shopping excursions. I am only partially kidding. This is something that, if it caught on across the nation, would go a long way toward restoring confidence in our economy.

Another thing to remember, from my prior updates, is that over the past nine recessions dating back to 1960, the markets began going up, on average, about six months before the economy actually turned around. When the economy finally did turn around, stocks were up, on average, about 25%. If that history holds true today, then we could see the market begin to rise soon.

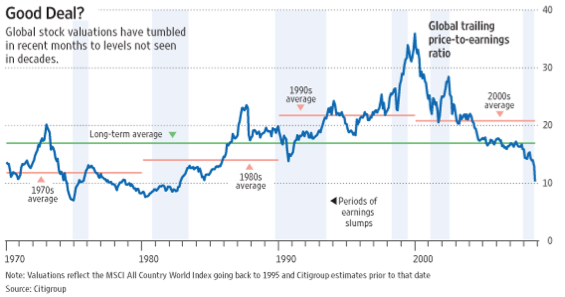

And we are prepared for that eventual rise. We recently rebalanced most of our accounts to take advantage of today’s historically low prices for just about everything out there. It is pretty much a fire sale. Look at this graph that shows how cheap today’s global stock prices have gotten. We have not seen stocks this cheap, as measured by their price/earnings ratios, since the 1970s and early 1980s.

Finally, take a look at this excerpt from this weekend’s Wall Street Journal. In it, level-headed columnist Jason Zweig points out the investment opportunities we, the average investors, have available to us today. Usually, the large institutions get all the goodies and we wind up with what’s leftover. But today, it’s the opposite because many of the large institutions are being forced to sell.

Our model portfolios contain most of the investments Zweig discusses in his column, with the exception of muni bonds (not prudent inside retirement accounts) and closed-end funds, which are difficult to buy cheaply for a large group of clients.

The bottom line is that we are moving forward through the crisis and every week that passes gets us closer to better days. We’re locked and loaded for when the markets turn upward. And while there’s nothing magical keeping stocks above 8000 on the Dow (in other words, we could still go lower), at least we can be confident that were a lot closer to a market bottom than the top. We also know that the market is cyclical in nature and that bull markets always follow bear markets—just like the day always follows the night.

So, stay calm, go out and spend money, and look forward to the economy improving next year.

Next week is Thanksgiving, where we have the opportunity to gather together with family and friends and celebrate how blessed we all are to be Americans in 2008. To help your families feel the true spirit of the holiday, try going around the Thanksgiving table and ask every person to describe the one thing they are most grateful for in their lives. You will help them learn a memorable lesson about what is most important about life and what is nothing more than passing storm clouds. And you will draw everyone closer together through the experience.

I’m sure the market and economy will also be a topic of Thanksgiving conversation. As many of you know, for years we have been closed to new clients. Given the current market conditions, my heart goes out to those who don’t have an advisor to lead them though these tumultous waters. With that, I am opening the firm back up to take on a limited number of new clients. If you know someone that you would like me to work with, and who you think would be a good fit for our firm, please feel free to refer them to me.

We all wish you great joy during the upcoming holiday season.

Alamo, CA neighbors and beyond it’s time to discover your Place of Possibility™ today. Our goal is to address every aspect of your life, defining a clear and actionable plan that meets your lifestyle needs. So, whether we’re holding your hand or taking more of the reins for you while you do life, you can rest assured that your money is growing and working for you while you enjoy it. Who knew?! Sound like something you’re struggling with or need more of? Get in touch to schedule a free 30-minute consultation, and let’s get started! You can contact us in a few different ways. One, by calling at 925.736.6410, you can send us an email at Info@APlaceOfPossibility.com or jump right into our calendar and select a date and time that works for you. We’re excited to meet with you!