Are International Stocks Finally Poised to Outperform?

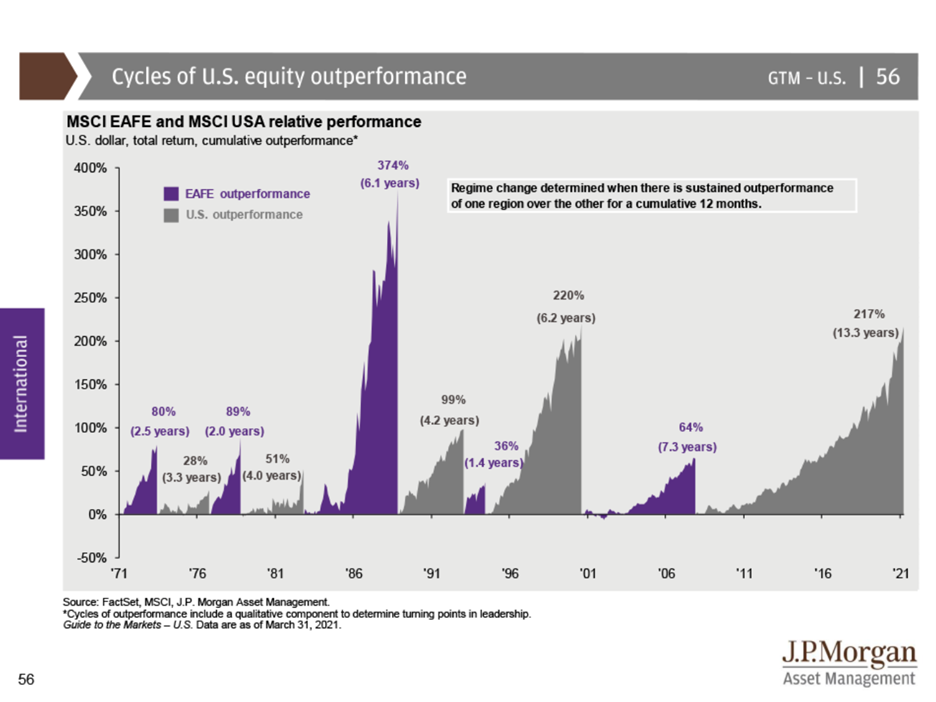

American stocks have outperformed stock markets in the rest of the world for more than a decade now, and we have fielded several questions about why we don’t allocate more assets to the US. It’s because we have very long memories over here, and data is telling us that the worm may finally have turned. The chart below shows how stock market outperformance has changed hands between the US and rest of the world every two to seven years over the last fifty years. For the last thirteen years, the U.S, has been the leader. It may be time for the cycle to switch.

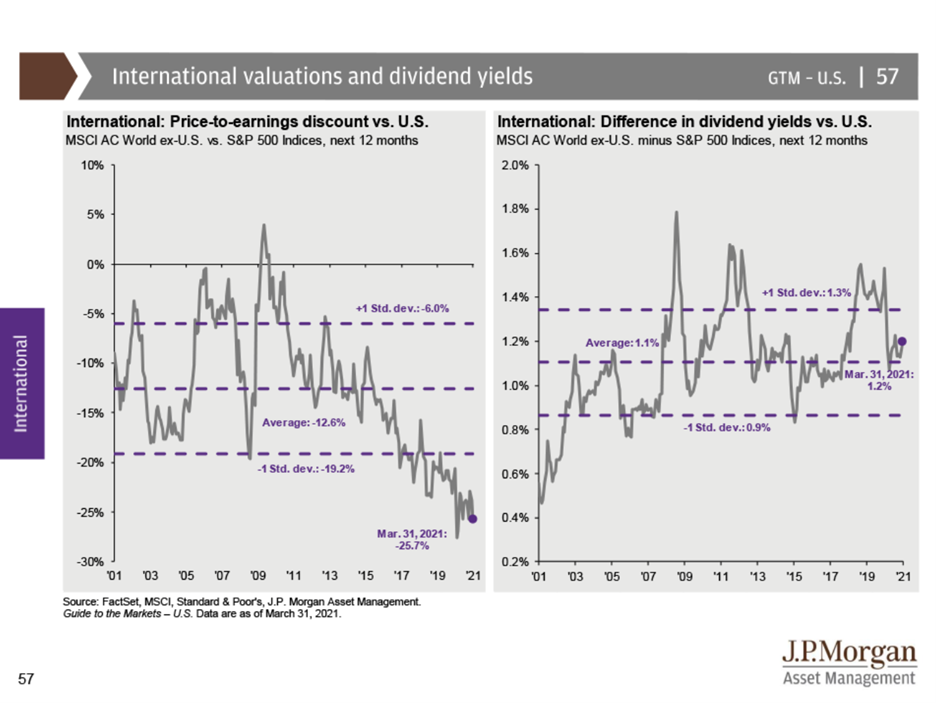

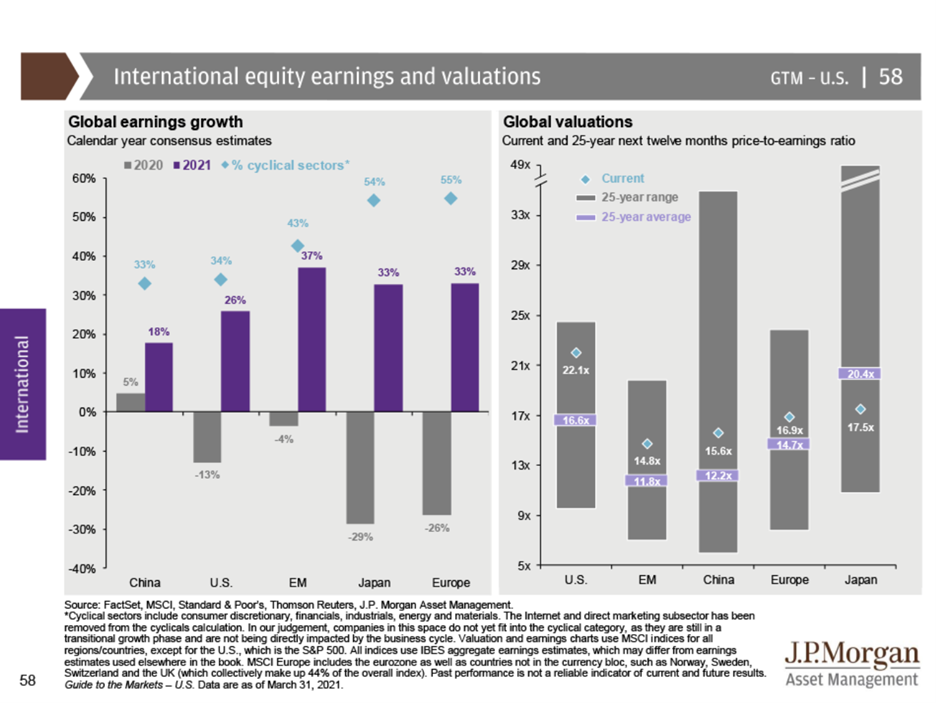

The chart below shows that non-US stock markets are, in aggregate, 26% undervalued in comparison to US stocks. The discrepancy has never been as high over the last twenty years. At the same time, Europe, Japan, and the Emerging Markets are expecting corporate earnings growth of between 33-37% this year, compared to 26% in the U.S. In addition, corporate dividend rates are 20% higher internationally than they are here. These factors increase the odds that foreign stocks may be the leaders in the near future, and this will be good for your portfolio!

One of the things we advisors do that we believe adds value to your life, is not allowing you to chase returns. What I mean by that is it is very common for people to place their assets in what is already performing well. The fault in that logic, though, is if something is already doing well, you missed the opportunity for gains, and you are more likely to simply ride it back down. Timing these sorts of moments is nearly impossible – trust me, I have tried. And if it were commonplace, many more people would be retired on beaches right now.

Instead, wise investors look at this data and allocate portions of their portfolio to these different asset classes so that they are already poised to benefit when the tides turn. This is one factor in good portfolio design, and the rest are left to another newsletter. Suffice to say, the data above shows it is prudent to have international stocks in your portfolio, and perhaps it might separate the wheat from the chaff in the next few years.

Calling all neighbors in the Alamo, CA area and beyond! You work hard for your money, and now we want to help make it work for you. At Del Monte Group, we offer out-of-the-box wealth management planning that is clear and actionable at every step. If this sounds like the type of financial support you need, schedule an appointment to meet with Richard or Angela today. Visit APlaceOfPossibility.com/Calendar to get your meeting on the books. Need more help or have another question? Feel free to contact our team by calling 925.736.6410 or sending an email to Info@APlaceOfPossibility.com.