Well, that was quite a roller coaster ride in the stock markets today! If you were watching between 11:30 AM and the close at 1 PM, you were treated to a real show. At one point, the Dow was dropping 100 points every three seconds, as panicked traders (I can’t bring myself to dignify them by calling them investors) sold shares furiously. At one point, the Dow was down over 1500 points before recovering a bit and closed down 1,175 points, or 4.6%. This brings the total drop in the Dow to 8.5% from the recent peak on January 26. Year to date, the Dow is currently down 1.5%, but it is still UP 14% over the last 12 months, so it is important to keep the right perspective when absorbing the high level of emotions generated in the moment.

Of course, the media is doing its normal job of scaring the pants off people. One headline today on CNBC.com is this doozy:

Dow's nearly 1,600-point plunge marks its biggest one-day point drop ever!

The blatantly misleading and utterly terrifying headline conveniently omits that in percentage terms, today’s drop isn’t even in the top 100 worst market declines, but it would never do to give you honest information now, would it? It also doesn’t remind you that we’ve had an extraordinary and unprecedented run of 12 months in a row of tremendous market performance, without even a single down month. Before last Friday, we were up 7% in less than a month!

Some clients have told me when the markets get scary, they always know they’re going to get a “feel-good” message from us, reminding them to stay calm and focus on the long run. One long-time friend and client jokingly told me that he thinks I yell to our staff, “Send out Letter 14 F,” to you, implying that we have an archive of old feel-good letters and just recycle them every time the markets drop.

Please know we will always be completely honest with you and will tell you if there are conditions or situations we are worried about and we think they could be big risks to your wealth and future. That said, over my 32 plus years in the business, there has not been a single time that I could honestly have said that I thought anyone should have been out, or gotten out, of stocks. Not one.

And for me, today is definitely not one of those times to be out. We just got a massive corporate tax cut, and corporate profits have been phenomenal, with over 80% of companies reporting their profit numbers this quarter beating the estimates. Those are extremely powerful tailwinds for the markets, and anyone ignores them at their own peril, in my humble opinion.

On the other hand, there are also inflationary concerns around the recent spike in interest rates, with the yield on the 10-year Treasury bond rising about 0.7% since last fall. I’ve lived through more interest rate cycles than I can count, and what I know is that whenever rates are rising, it is almost always because the economy is doing well. We are now in our tenth year post-crash, and bond market seems to be telling us that we are only now, finally starting to turn the corner toward a more vigorous and sustainable economy that no longer needs low interest rates to prop it up. It’s kind of like a patient in the ICU finally doing well enough to be able to come off life support. To me, higher interest rates are actually good news, but the stock markets often seem to initially be very fussy accepting them. Soon, though, they fade and once again the markets start looking ahead to how corporate profits are going to do, which is THE main driver of stock prices long-term.

How long will the current hissy fit last? Hard to say, but we know that periodic market “corrections” of 10-15% are the norm, so maybe another 2-7% or so would be a good guess. That said, we might find out that today’s intra-day low of -1600 could turn out to be the bottom this time around.

No matter what happens in the days ahead, stocks have been WAY overdue for a retrenchment. It’s normal, it’s healthy, and it’s necessary. It just doesn’t feel too good. But we have learned that feelings and stocks do not play well together. A lot of people who sold in the last week are going to wind up getting burned, just like every other time in history that this has happened.

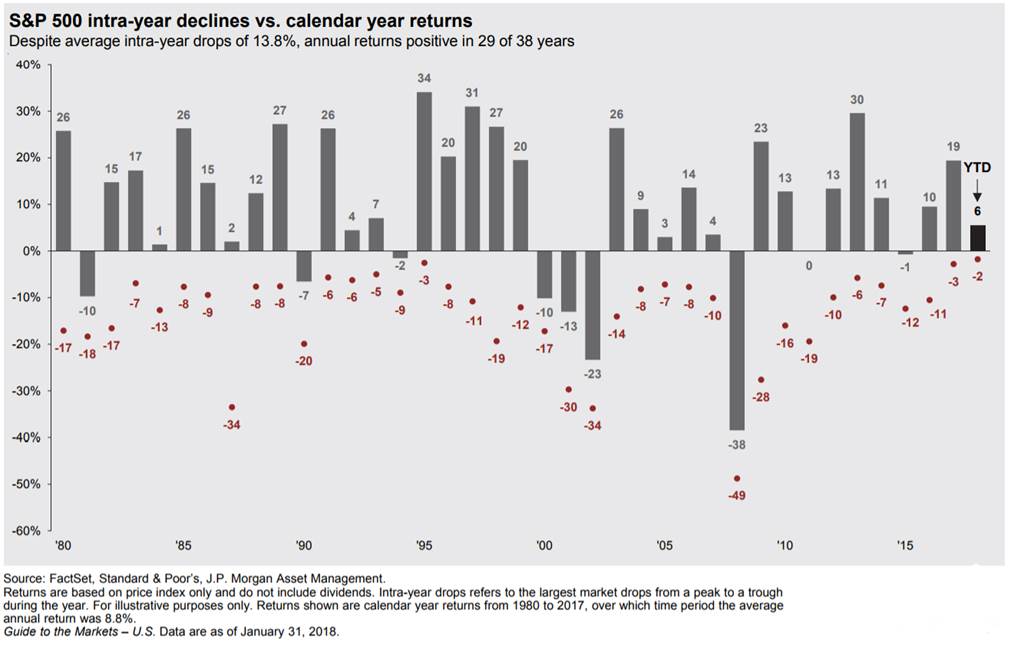

Please see the graph below showing the biggest intra-year declines for the S&P 500 Index, versus where the market ended the year. The difference is often very dramatic; 20-30% differences and more are pretty normal.

So don’t let this market get you down. We are constantly on the lookout for opportunities to “buy low” and add to your stock holdings (if you're already a client. If not, what are you waiting for?). We’ve been doing that all this week for clients who can benefit, and you can rest assured that we are on the lookout for you also.

So don’t let this market get you down. We are constantly on the lookout for opportunities to “buy low” and add to your stock holdings (if you're already a client. If not, what are you waiting for?). We’ve been doing that all this week for clients who can benefit, and you can rest assured that we are on the lookout for you also.

Calling all neighbors in the Alamo, CA area and beyond! You work hard for your money, and now we want to help make it work for you. At Del Monte Group, we offer out-of-the-box wealth management planning that is clear and actionable at every step. If this sounds like the type of financial support you need, schedule an appointment to meet with Richard or Angela today. Visit APlaceOfPossibility.com/Calendar to get your meeting on the books. Need more help or have another question? Feel free to contact our team by calling 925.736.6410 or sending an email to Info@APlaceOfPossibility.com.