The stock markets continue to be very volatile and on Tuesday, October 28th they unexpectedly exploded upward through the 9000 level on the Dow Jones Industrial Average. So far the intra-day low below 8000 that was set on October 10th continues to hold, but it’s still possible we could go below that before this is over.

At month-end, it looks like we have gotten past the panic over whether global credit markets would stay locked up, and for the past three weeks they have slowly continued to improve. We got some solid data on Thursday with 3rd quarter gross domestic product (GDP) coming in a -0.5%. This means the economy contracted slightly between July and September. No doubt we will get contraction this quarter too, so we now know we are in a recession. The biggest question stock investors around the world are asking now is how deep and long this recession will be. Because we really don’t have solid data to run on at this point, the markets seem to be pricing in close to a worst-case scenario for corporate profit growth going forward. In less scary times, the market might be a little more forgiving about not knowing how deep and long a recession we’ll get, but in today’s environment, they are not in any mood to be generous. So in my opinion, this is why stock prices have been so volatile and remain so low.

To give you an analogy of how investors have been reacting to all the frightening news for the last couple of months, imagine yourself in a pitch-black room, groping around and trying to find the door. If the lights went out while you were watching Mary Poppins on TV, you might kind of laugh and think the experience of trying to find your way out was amusing. But if you had been watching Alfred Hitchcock’s Psycho at 3 AM and the lights went out, you would have a very different experience. Yet, the reality of the experience, the lights going out, is identical in both cases. The only difference was your emotional reaction to what happened. The first time you were amused, but the second time you were in full-flight panic.

This is analogous to what is happening in the financial markets. We have full ability to choose our reaction to the events. We can choose to see the current situation as another in a long series of bear markets that will ultimately end with markets going on to higher highs. With this attitude, we would likely see many great (and very rare) investment opportunities in the current market, and look for ways to profit from it. This is what Warren Buffet has been doing, and what John Templeton and many other highly successful investors have done repeatedly in the past.

We could also decide to give in to the sense of gloom and terror that we feel today and flee the markets. This might help us feel safer for the moment, but the feeling wouldn’t last very long. Because unless you are never going to get back into stocks in your lifetime, you face a much more difficult choice after you have gotten out: when to get back in. The answer seems obvious now, right? You’ll get back in when things look better. It sounds great, but the reality is that for the vast majority of investors, by the time things look better, the markets are higher—usually much higher. So, solving today’s fear problem sets you up for the far worse problem of missing out on profit you could have made if you had just held on and never gotten out of the market in the first place. And the scariest scenario of all is to get back into the market later, at higher levels, only to see the markets go down again, providing you the distinct honor of losing twice. Poor market timing is the main reason that while the S&P 500 Index returned 11.8% annually over the last 20 years, the average small investor only made 3.7%.

You might be asking yourself, “What am I supposed to be holding on for, exactly? The future looks bleak and all the experts are predicting a long, protracted recession at best.”

First, think back to a year ago and what all the so-called experts were predicting at the time. The market was hitting all-time highs and nobody (except the crackpots that have been saying the same thing for 25 years—even a broken clock is right twice a day) was predicting we would be where we are today. Go back and read some of the newspaper articles at the time and look at the predictions they were making for 2008. Everything was rosy. The point here is that the experts are of no value whatsoever in predicting what will happen in the future. Nobody knows how long or deep any recession might be, or how quickly things might snap back after the panic period ends. So what real value do we get from listening to them?

One of the most visible of the so-called experts is Jim Cramer whose show, Mad Money, airs on CNBC. He's undoubtedly a smart stock guy, and he puts on a rambunctious and entertaining show. But what he sorely lacks — and what you must never forget in your investing days — is temperament. It was Warren Buffett who once said that “the most important quality for an investor is temperament, not intellect.” Go back and do a Google search on all the previous predictions Cramer has made and you will quickly see that this Emperor has no clothes whatsoever. He has already called the market bottom several times this year, and also said that 2008 was going to be the year of natural gas. Right.

Earlier this week we emailed clients a terrific presentation on market behavior during previous panics and what the media and the experts were saying at the time. A few of our clients do not have email addresses and were not able to see it. If you are among them but have access to the Internet, I strongly encourage you to view it at this web address: http://www.dfaus.com/library/videos/different/

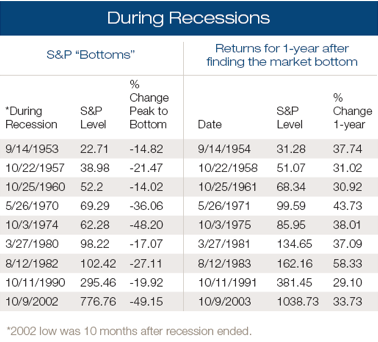

The charts below show what we are holding on for. The first one shows stock market performance during previous recessions dating back 55 years to 1953. The average decline in the S&P 500 Index was 27.54%, but the two worst declines were 48% and 49%. [Note that as bad as the current markets have been, they still have not gone down as much as the two worst declines in most of our lifetimes. So when you hear that things are really different this time, remember that this is false.] Now look at the market performance one year after the market bottomed. The average gain was 37.74%.

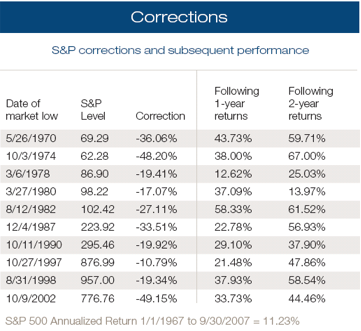

The next chart shows stock performance one and two years after the market bottomed, since 1970. You will notice that there have been ten market corrections since 1970. (There are ten because markets often decline without economic recessions.) Here again, the big market declines are followed by an average 27.90% gain after one year, and 47.29% two years out.

Now, this is all well and good, but we have no intention of just passively waiting for the markets to come back. Instead, we’re going to take full advantage of the low markets by rebalancing your portfolios to the model percentages that they had last year at this time. For clients with a 60/40 model portfolio that started out with a 60% weighting in equities, their portfolio is today closer to 40-45% equities. Those with a 40/60 model portfolio started with 40% in equities and may now have 25-28%, all courtesy of the current bear market.

Rebalancing your account back to last year’s stock weightings allows you the opportunity to really profit from the current stock market declines. So when the Dow Jones Industrial Average gets back to its all-time highs above 14,000, you will not just be even, you will have profited handsomely. Let’s do the math:

Let’s say we invested $10,000 at the market highs in October of last year, into a stock mutual fund selling at $10.00 a share. Our $10,000 would have bought 1000 shares of the fund. Today, a year later, because of the current global crisis, that same fund would be down 50% and selling for $5.00 a share. If we rebalance our portfolio and invest an additional $5,000 into the fund, we would buy another 1000 shares, bringing our total holdings of the fund to 2000 shares. To break even on the $15,000 we have invested to date, the fund will need to go back up to just $7.50. Down the road, when it gets back to the $10.00 a share price we paid for the first shares we bought, our total profit will be $5,000 or 33.33% on our total original investment.

What this means to you is that we really can make money from the current downturn merely by doing what history tells us we should do (see charts above), instead of what our instinct tells us to do (run and flee). The charts show strategies that have worked 100% of the time over the last 50 years. And while they don’t absolutely guarantee success this time, they certainly give us something solid to work with in planning for the future. Perhaps most importantly, we no longer have to even listen when the Jim Cramers of the world spout this week’s version of their philosophies, which may or may not turn out to be accurate. How about instead we put our faith in what has worked before—every time.

Your October Account Statements

Finally, I want to prepare you to receive your October account statements in the coming days. Halloween is going to last into November this year, I’m afraid. I’m writing this on October 30th, and things can still change by tomorrow, but very few Halloween tricks could be more frightening than those statements are likely to be. Since 1990, stocks have experienced double digit monthly declines several times, so this is nothing new, but it looks like this month could be a little worse. As a result of this month’s market decline, we’ve seen total account values decline between 6% and 18%, depending on the level of stock exposure in each account. I completely understand that this level of volatility was nothing you ever contemplated for your hard-earned money.

What’s more, the “stable” portion of many portfolios has been anything but stable. For example, some municipal bond funds lost 5% in October, and inflation-protected government bonds (TIPS) lost 8%! 8% lost in a month for an investment 100% guaranteed by the full faith and credit of the US government! The market has really shocked everyone. I also want you to know we did the right thing by sticking with our long term asset allocation. Like the analogy of the dark room I discussed above, I hope you are able to see this market event for what it is—so far, it’s another classic bear market, one where the declines have been compressed into a shorter time frame than usual. During the 2000-02 bear market, it took 2 ½ years for stocks to decline 49%. It lasted so long that it felt like Chinese water torture. This time, stocks have dropped 43% in 12 months. Having lived through both periods, I have to say I prefer to get unpleasant things over with as quickly as possible, so to me this market has been a little easier to take.

I also want to really encourage you to avoid the temptation to let your mind wander into to the train of thought that goes like this, “If this keeps going on like it has been recently, I’m going to be completely broke in XX years.” That is Psycho talking—it’s not reality. The lights never stay out forever, a knife wielding Anthony Perkins isn’t really in the shower with you, and this bear market is going to end, and sooner rather than later, in my opinion.

The simple truth is that while others are panicking and running for the hills, we can profit from this whole mess by simply having the courage to rebalance. Several clients have called and emailed me asking to increase your stock exposure above last year’s weighting, in an effort to capitalize on the current bargains that abound in the equity markets today. I want to honor you for your guts and foresight. I have zero doubt that you will be amply rewarded for your decision. If this sounds interesting to you, please give me a call. We probably won’t see opportunities like this again for a long time, if ever.

PLEASE CALL ME with any concerns, fears, worries, episodes of panic or depression, etc. that you have in the coming weeks. We can work out something to get you through. I’ve been doing this for decades and there’s nothing you can say to (or yell at) me that will surprise me.

I care deeply about your financial security and future, as does my staff. These last few weeks have not been easy ones for any of us, and I very much appreciate your calls and messages of support and concern for me. I am very optimistic that you will truly be able to profit from all this turmoil. If we get the same kinds of returns in the coming years that have occurred over the last 50 years, we will end up in good shape when all is said and done. And I can’t think of anything better that I can give you.

Sincerely yours,

Richard

“One-size-fits-all” won’t fit you here! The Del Monte Group team understands that everyone’s financial goals are unique. That’s why we always provide customized advice. No matter where you are in life, you can depend on our proven expertise to provide financial planning support for long-term success. Ready to get started? Schedule a meeting with Richard or Angela in our Alamo, CA based office today or we can meet via Zoom! >> You can select a date and time that works for you via our calendar, call us at 925.736.6410, or send an email to Info@APlaceOfPossibility.com. We can’t wait to help you!