We have experienced more heavy downward volatility over the past two weeks, culminating with a 250 point drop yesterday. Stocks have dropped 14% over just the last nine trading days and are off a total of 19% just since the beginning of the year. I’d like to discuss some significant historical bear markets to help you understand how this one stacks up. I’ve heard people (including President Obama) utter phrases like “next Great Depression.” Despite these numbers, our accounts are only down 4.5% on average this month, so we are faring much better than the markets. Nevertheless, it’s no fun seeing more declines in value after last year.

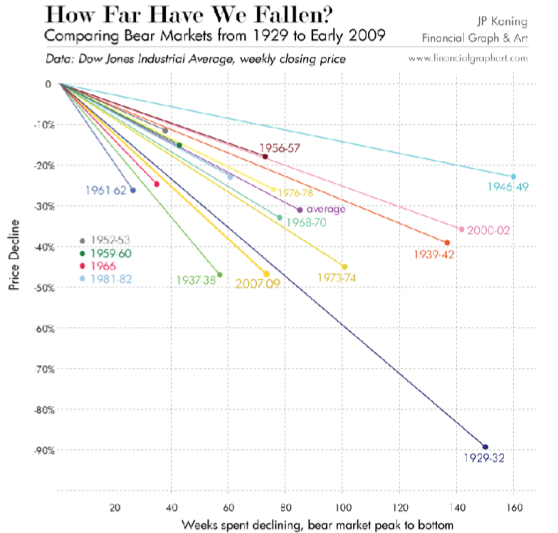

Since the bear market began in October, 2007, the S&P 500 has declined 52.5%, making this officially the worst bear market since 1929-32. The other two great bear markets were in 1973-74 and 2000-02.

The stock market declines for the other big bear markets were:

1929-32: -89%

1973-74: -53%

2000-02: -49%

So, we are tied with the second-worst one of the last 80 years. Where to from here? Of course nobody can answer that, but we can look at the conditions that existed during the previous great bear markets to search for comparisons.

The bear market in the early '30s correctly predicted a true economic catastrophe brought about by flawed fiscal and monetary policy and an enormously disruptive trade barrier. Unemployment skyrocketed, peaking at 37.6% in 1933, while the per capita money supply fell by approximately 30% from 1929 through 1933. During this same period prices fell by 10%. To complicate a collapsing economy, President Hoover raised personal income taxes. The politicians and bureaucrats couldn’t have made any more bad economic decisions; by 1933 they had made them all.

In contrast, the bear market of the mid-70s was characterized by double-digit inflation, encouraged by President Nixon’s abandonment of the gold standard, the implementation of wage and price controls, and the competition from fixed-income securities that yielded double-digit returns. Yes, President Nixon raised personal income taxes, too. At the peak, the maximum personal income tax rate was 77%. Also during this period, the country endured the Arab oil embargo, a 10% devaluation of the dollar, Watergate and Nixon’s impeachment vote and subsequent resignation, the largest bank failure in US history, and 142,000 layoffs in the auto industry in December, 1974.

The 2000-02 bear market was brought on by the spectacular collapse of the tech bubble, and fed by the 9/11 terror attacks, a short and shallow recession, and the collapses of Enron, Worldcom and others.

This time we have some similarities and also some differences compared with the other big drops. But the big question that I know is in your minds is this: Why in the world should we hang on to stocks in the middle of a mess like this?

Here are some thoughts. First, we are already at levels that in the past turned out to have been at the very market bottom. Despite how absolutely gloomy it feels today and how much worse the news seems on the surface, go back and read the descriptions of the past great bears and you can see that we are no worse off now than then—especially the 1973-74 period. So to me, the odds favor that we are probably in the vicinity of the bottom. Yes, there could absolutely be more downside but I do not think we are heading off into a repeat of the 1929-32 collapse.

For those that think we are headed into another Great Depression, I would ask where the bread lines are forming. Where are the soup lines? Where are all the hoboes riding the rails around the country in search of work? Where are all the Hooverville tent cities filled with homeless scattered around the country? For that matter, where is the 37.6% unemployment rate? Today, we are at 7.6% unemployment so it will have to increase by 400% to get to the levels of 1933s. Do we really expect this to happen today?

Back in the 1930s, there were thousands of bank failures and no FDIC deposit insurance. The savings of millions of Americans were wiped out. There was no unemployment insurance or Social Security early on. It’s no wonder things got as bad as they did. But can that really happen today? Our government, in tandem with other governments worldwide, hasn’t had spectacular success with their efforts to ease the pain, but they are definitely pushing us in the right direction. Contrast that with the 1929-32 bear market when everything they did made things worse.

Take a look at this graph of the market today versus the other historical bears. You can see that this bear is now down more than all the others except the Great Depression.

Now, let’s look at how the stock markets performed in the aftermath of the other big market bottoms.

1929-32: Within six months of reaching the bottom at the end of 1932, the Dow was up 93%. Five years after hitting bottom, the Dow was up 371%.

1973-74: Six months after making a bottom in December, 1974, stocks had gone up by 53%. This despite the 142,000 auto industry layoffs that occurred after the market had already bottomed.

2000-2002: Fourteen months after the bottom in October, 2002, stocks had rebounded 43.5%.

Each and every time, at the bitter end of the bear market, pessimism was just as bad as it is now. Nobody could see a turnaround in sight. Yet, a spark somehow ignited and the next bull market was born. What will that spark be this time and when will it light? It’s hard to tell. But it is almost certain to happen when it is least expected.

We have had two consecutive months of Leading Economic Indicators rising, plus back to back increases in retail and existing home sales. This morning we learned that retail continues to improve, even though consumer confidence has fallen to the lowest level in the past 40 years. These flickers of improvement haven’t been widely reported because it’s much more terrifying (and increases readership and viewership) to report the bad stuff. Time will tell if these uptrends stick, but eventually they will.

The current climate in the country reminds me of that scene in my favorite movie of all time, It’s a Wonderful Life. The mob of customers are all there to withdraw their money from the Bailey Building and Loan and Jimmy Stewart gives them his classic pep talk about not giving in to their fears. And outside you can hear the police car racing by with the siren blaring. I wonder if we are getting too soft. If our confidence can fall to record lows when the situation is not nearly as bad as it has been during previous downturns, what does that say about us?

Of course, part of the blame lies with our new president, who played the “Catastrophe” card over and over in an effort to get his stimulus plan passed. It’s no wonder that consumer confidence is the lowest ever recorded. I had really hoped he would be a better crisis leader than that. Had he been George Bailey in that scene described above, he would have run over to the window when the police car raced by, panicked, and ran off to sell his shares at 50 cents on the dollar to Old Man Potter. Geez.

I have attached a discussion about the recent survey of economists who now expect Gross Domestic Product to begin increasing slightly during the second half and grow stronger into 2010. Hopefully that will help bring about a resurgent stock market.

I know that some investors are still going to cash portfolios, in an attempt to reduce their losses. Now is not the time to implement this strategy. You have stuck around and have certainly paid the price to be able to get the great returns the markets promise. Don’t back down now. Do you really want to miss out on the payoff when it comes by being out of the market?

Don’t forget that each of you who is living on distributions from your accounts has several years (at a minimum) worth of distributions sitting in safer fixed income investments. Most of you have eight or more years worth, and some of you have over forty years worth of distributions there. This means you can realistically stop worrying about stocks going down and instead sit back, relax and let the stock market continue in its cycle without your having to do anything. All you need to do is give yourself permission to let your investment strategy work, because you have the wherewithal to survive the current downturn.

Dalbar, a Boston-based investment research company, tracked investment results from 1986-2005. Over that period, the S&P 500 Index returned 11.9%. But the average individual investor only made 3.9%. There is a reason why the vast majority of individual investors underperform the stock market indices over time: They get emotional and do the wrong things at the wrong time. They get greedy and load up on stocks at market highs, and they panic and sell out at the lows. Over and over—like clockwork. I can almost guarantee that when Dalbar runs their next survey covering this current period, the results will be equally ugly, if not much worse.

If you have enough safe money to last you for years, and you know that selling at the bottom is a bad idea, why do it? I don’t want you to get the idea that we are having mass liquidations to cash among our clients. In fact, this year, we have only had two clients that did so. I am really in awe of your collective guts and determination in the face of the worst bear market in our lifetimes, and I salute you for it. But I know you are feeling that urge intensely.

I hope for all our sakes that this market hits bottom soon so we can get on with the inevitable recovery. A lot has been said about how different things will be from now on. Here are some things you can count on that will be different.

- Americans will be more frugal than in the recent past. They will place greater emphasis on saving money. They will carry less debt, will be less inclined to participate in the latest investment fads (for a while a least), and will not use their homes as an ATM machine. This will result in a short-term hit to consumption, but in the long run will make our people and the entire nation more self-reliant and resilient.

- Banks will no longer be allowed to make loans, securitize them and sell them off. They will have to return to the days of nurturing relationships with their customers. They will be required to operate in a manner consistent with the role they should play in a society-as part of its foundation. As such, they will need to avoid any dealings with exotic investments. Leave those for the hedge funds.

- Wall Street as we knew it before 2009 no longer exists. They have finally incinerated themselves by their own greed and avarice. They bear great responsibility for most of the financial scandals that have plagued our nation for many years now. In recent years, they were involved in the Worldcom and Enron frauds, they were guilty of knowingly pushing worthless high-tech IPOs on the markets back at the beginning of the decade, and of course they finally destroyed themselves with the toxic mortgage securities they created. This week, two of the commissioners on the SEC have openly asked if we shouldn’t make the so-called “fiduciary standard” the standard of care for financial advisors. If this were to happen, you would see the complete demise of the Merrill Lynch business model in the financial services world, in favor of what the independent investment advisors like our firm have long been demanding.

A fiduciary standard of care means the advisor is duty-bound to provide the BEST, conflict-free advice he or she is capable of giving their client. Unfortunately, for too long, the standard of care for these broker firms has been one of “suitability.” Thus the question was not, “did you give your client the best possible advice?” Rather it has been, “was the advice you gave your client “suitable” for what they needed?” So they have been allowed to push a bunch of high-cost, high commission-paying and poorly performing investments on their unsuspecting clients and hide behind the “suitability” standard.

Because of the current mess we are in, we have what might be a once-in-a-lifetime chance to reform the standards financial advisors have to live under. I cannot overestimate what a profound difference a fiduciary standard would mean to the lives of every American. Can you imagine never having to worry if a broker was recommending an investment because they got paid more than if they recommended something else? How about the peace and security of always knowing your advisor was legally obligated to give you the best advice they were capable of giving? Think there might be better relationships and higher levels of trust in the advisory world?

If you want this, now is the time, while they are formulating the reforms they will impose on the financial community, to contact the SEC and let them know your concerns. For once they are listening!

OK, you know how I feel. Please call me with your concerns and questions. We know you are worried, so don’t be shy.

Every client that walks through our door is family. Your goals are our goals, and that’s why we work hard to provide a true Place of Possibility™, so we can help you meet and exceed them. Our wealth management services work to navigate life transitions and take advantage of unique planning opportunities that leave you feeling calm and confident. We offer solutions based on you and your needs, not strategies that make us a quick buck. No matter how life unfolds, we’ll help you connect the dots and always have your back. The door to our Alamo, CA-based headquarters is always open. How can we assist you? Call us at 925.736.6410, send an email to Info@APlaceOfPossibility.com or jump right into our calendar and select a date and time that works for you and let’s talk.