Market Update: First Quarter 2021

By: Angela Wright, CFP®, FEA

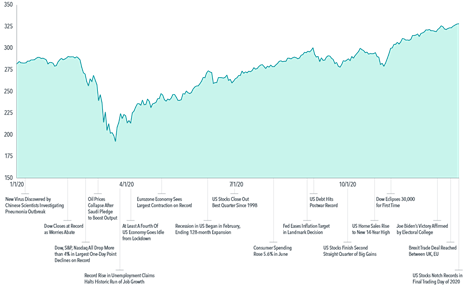

Well folks, the year we collectively loathed has finally ended and we have a little distance from it! Although January started off rocky (and we were all wondering if that was indicative of what the year would bring), three months later the waters have smoothed out quite a bit. The markets are behaving, people are getting vaccinated, and all indicators are pointing to a good year for investors. Let’s start with a look at last quarter.

Overall, US stocks gained 6.3% in the first quarter, despite the uncertainty in January and some really unusual trading activity in GameStop and some other stocks later in the quarter. International developed stocks (think Germany, UK, Japan) gave us 4%, and International Emerging Markets (think India, China, Brazil, Mexico) gained 2%. Global real estate is up 6.2% . That’s kind of a shocker, isn’t it?

Breaking up the US returns a bit more to see what drove them, small cap value stocks were up 21%, large caps were up 5.9%, and tech stocks gained 2.7%. We think that rumors, optimism, greed, and fear of losing out brought investors back to market-normality (at least as close to it as we can get). Housing news continued to be positive, but results were well short of estimates, as costs continued up and supply remained low, making it a seller’s market (tried to put an offer on a house lately? Yikes!). Weekly Unemployment Claims returned closer to the pre-COVID level, breaking under 700,000 (in March 2020, it went from 282,000 to 3.3 million, reaching the weekly high of 6.9 million that month). The Fed maintained that it would continue to be accommodative—and made moves to prove it. Optimism ruled, and all you had to do to profit from it was to not be the last one into the market.

In the US bond market, prices dropped by 3.37% and international bonds lost 1.9%. This happens occasionally, though it is infrequent. The current yield on the 10 Treasury-Note is 1.1%. The last time the 10-year treasury yield was above 1% was March 19, 2020. When investing in bonds, there is an inverse relationship between interest rates and bond prices. When interest rates rise, as they did in the first quarter, bond prices fell. By comparison, when interest rates were falling in 2020, bond prices rose by about 17%. The concept that bond prices and yields move in opposite directions is often confusing to investors.

Through the years I’ve heard the following questions from clients: “If interest rates go up, shouldn’t this be good for bonds?” “Why would higher interests rates cause a bond’s value to go down?” “If interest rates go up, shouldn’t the value of a bond go up as well?”

I’ll unpack this for you with an example, let’s say you paid $10,000 for a five-year bond that pays 4% annual interest. Six months later, interest rates go up, and new bonds are now paying 5%. If you decided to sell your bond, do you think anyone would pay $10,000 for your 4% bond when they can pay $10,000 for a new bond paying 5%? To entice someone to buy your bond, you would have to sell it for less than $10,000.

The reverse is also true. If, six months later, interest rates went down to 3%, your 4% bond now becomes more valuable to individuals interested in buying a bond. As a result, they may be willing to pay more than $10,000 to buy if from you.

Interest-rate changes have a similar effect on bond funds as well. Most bond funds (which is how your portfolio is invested in bonds) hold hundreds of individual bonds and are generally categorized by their duration rate. Duration is a measure of the sensitivity of a bond’s price to changes in interest rates. Duration incorporates a bond’s yield, coupon, maturity, and other features into one number, expressed in years.

As a general rule, for every percent increase or decrease in interest rates, a bond fund’s price will change about the same percentage in the opposite direction for every year of duration. For example, if interest rates increased by 1%, a bond fund with an average duration rate of three years would lose about 3%. A bond fund with an average duration rate of 10 years would lose about 10%. If rates went down by 1%, the funds would gain 3% and 10%, respectively.

Bonds have historically provided downside protection during periods of stock-market declines. In the 10 bear markets over the last 50 years in which stocks lost an average of 27%, bonds provided an average return of 10.8%. You often hear us say that they “smooth out the ride” and this data shows why.

Turning our attention to international waters, we continue to be both surprised to an extent, and delighted to see what happened over the last year. Many were worried the world might utterly collapse but instead the chart below shows that corporations still managed to earn profits in spite of the pandemic.

This is a good reminder to us all to focus on what really matters when it comes to evaluating an investment. Things that don’t matter? Who serves as US president, where people work (office vs. at home), what your neighbor is saying, what anyone on TV is saying, what made money last year, what month it is, and on and on. What does matter? Corporate profits. We look at the price of a stock relative to its earnings (P/E ratio), the return a corporation is getting on its capital (ROA or ROE), the earnings per share of the company outstanding (EPS), who is on the board, competitive advantages and patents, our holding period, and a lot more.

So on the daily, your job as an investor is to make good choices, ignore the news, and wait. I’ve noticed waiting is particularly difficult for us Westerners, especially when we’re obsessively glued to devices constantly showing us news with more and more insane headlines to grab our attention. We’re almost set up to fail emotionally as investors, given the climate we live in. But DMG won’t let you fall into this trap. We continue to do the fundamental analysis and make changes as necessary, meanwhile helping you understand and make good choices in other areas. Please give us a call if you have questions about this or any other investing topic.

Alamo, CA neighbors and beyond it’s time to discover your Place of Possibility™ today. Our goal is to address every aspect of your life, defining a clear and actionable plan that meets your lifestyle needs. So, whether we’re holding your hand or taking more of the reins for you while you do life, you can rest assured that your money is growing and working for you while you enjoy it. Who knew?! Sound like something you’re struggling with or need more of? Get in touch to schedule a free 30-minute consultation, and let’s get started! You can contact us in a few different ways. One, by calling at 925.736.6410, you can send us an email at Info@APlaceOfPossibility.com or jump right into our calendar and select a date and time that works for you. We’re excited to meet with you!