Dear Clients,

We have to stop meeting like this, but I’m writing with a brief update on the continuing volatility in the financial markets. The markets appear to be reacting to the Fed’s latest 0.75% interest rate hike as if they are shocked that it happened, even though the Fed has been telegraphing it would do exactly that for many weeks now. For a brief few minutes after the Fed’s announcement earlier this week, the market actually soared more than 300 points on the Dow, before cratering. It has continued to fall since.

At this juncture, fear has taken over the markets. Is the fear justified? You be the judge:

- The latest story market participants are telling themselves and each other is that since inflation has not declined much as a result of this year’s Fed tightening so far, the Fed is going to have tighten much more, and by continuing to raise interest rates indefinitely into the future, it is going to cause a “hard landing” in the economy that will lead to a recession next year.

However, in a Wall Street Journal essay written by Alan Blinder, former Vice-Chair of the Federal Reserve from 1994-96, the Fed has actually done a good job of engineering a “soft-landing” (a reduction in inflation without causing any recession at all) in six out of the last eleven Fed tightening cycles. The five periods with “hard landings” included two periods where the Fed actually wanted to cause a hard landing, and three periods where unexpected external events, including an oil shock, occurred that caused a recession in the U.S. So, the odds of a soft landing are much better than many think.

Blinder also says people forget that there is always a lengthy time lag between the time the Fed starts tightening and when the hoped-for decline in inflation begins to show up, so a mistaken lack of patience may be playing a part in the market’s current tantrum.

Finally, during the last period of high inflation in the early 1980s, nobody expected the Fed’s tightening to be able actually reduce inflation. They couldn’t imagine a return to low inflation was even possible. Today, however, everybody remembers what it was like only a year and a half ago when sub-2% inflation was the norm. As a result, inflation should be easier to eradicate than it was 40 years ago.

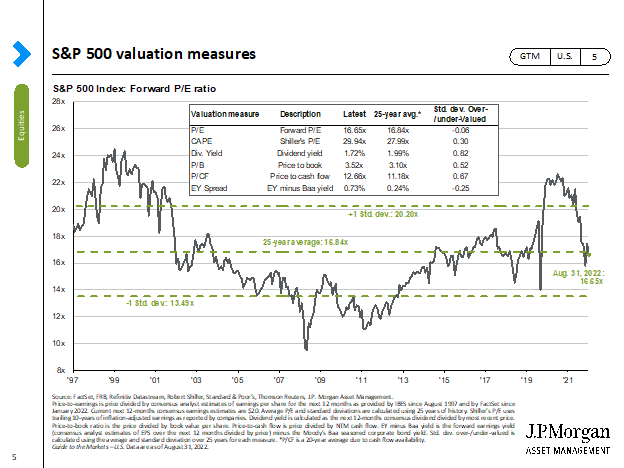

- Stocks have gotten much cheaper of late and the current forward price/earnings ratio of the S&P 500 (used as a measurement of relative value) is around 15 times earnings. This is quite a bit below the average P/E over the last 25 years of 16.84 as shown in the chart below. Note the data in the chart is from August 31st and the markets have declined in the last three weeks so the current P/E is lower than the 16.65 shown in the chart.

While stocks could always go even lower than they are now, they are on the cheap side today, making the implied expected return going forward very close to, or slightly better than, the long-term average of 11% per year.

- Stocks are really not down all that much this year, at least by historical standards. As of the market close today, the S&P 500 is down 22.5%. While that’s not insignificant, it’s neither unusual or catastrophic and markets can quickly recover. The reason it seems so much worse to most of us is we have had to endure not just one but TWO separate periods of decline this year. The first was a decline of 22.5% between January and mid-June. Next followed a very rapid recovery of 17% between mid-June and mid-August, followed by another 14% decline since then. So we have had to live through the same losses twice, and together they add up to almost 37%! No wonder it seems so much worse!

- Finally, here are some facts to chew on. Over the 20 years between 2002-2021, the S&P 500 earned an average annual return of 9.5%. During that same time, a 60% equity/40% bond portfolio earned 7.4% a year and a 40/60 portfolio returned 6.4% annually. Over that same time period, the average investor earned just 3.6% per year. I think you can probably guess why the Mr. and Ms. Average did so much worse. They allowed their emotions to get in the way and ended up selling low and buying high; the exact opposite of what we all know we should do. Here’s a graph showing how that plays out. It is as consistent as the sun rising and setting. Like you, we want you to be in the successful group of investors. Right now, that means staying in your seat and not acting on fears and imagined catastrophic futures that have never before materialized.

Please don’t despair. This too shall pass. Call us next week if you want to talk. We’re here for you!

Sincerely,

Richard and Angela