Well, we ended up having a pretty calm summer after all. With the Brexit vote that started out the season, it looked like it might be anything but calm, but over the ensuing months, the market handled every piece of bad news like it was nothing. Even September, a month that has had some of the worst market drops in history, have been pretty calm. This despite the fact that we are in the closing days of the most wacky and unprecedented presidential election cycle in recent history. The markets have been very resilient and all that strength makes us wonder if better corporate profits are not headed our way. It was a darned good quarter for diversified investors; global markets overall had their best quarterly returns since 2013. It was one of the few quarters, over the past five years or so, where the S&P 500 was not one the top performers.

The S&P 500 index of large US company stocks posted a gain of 3.3% in the third quarter, and is up 6.1% for the year so far. US small company stocks fared even better—up 9% for the quarter, pushing the gains to 11.4% for the year.

Looking abroad, we had more positive market returns. International large company stocks, which have lagged behind US stocks for some time, gained 5.3% for the quarter, pushing them into positive territory for the year, up 3.1%. Not to be out done, small international companies were up 8% over the last three months. Emerging market stocks fared the best of the bunch. After being largely left for dead after years of poor performance, emerging markets proved they still have a heartbeat, jumping 9% for the quarter and over 16% for the year.

On the bond side, interest rates in the US remained essentially unchanged—rates are still low and bond prices held steady. After falling to an all-time low of 1.36% in early July, 10-year treasury yields have recovered slightly to end September at 1.60%. Bond rates across the globe remain well below where they started the year, which has been beneficial for bond prices.

When you consider all that has transpired thus far in 2016, from the S&P 500 having its worst start to a year ever (a 10.5% decline in just six weeks) to the unexpected Brexit vote in June, markets around the world have shown incredible resilience. Those who have had the stomach to endure the bumpy ride have been rightfully rewarded.

As we look ahead to the remaining three months of the year, there are two issues that are likely to dominate the news headlines: speculation around the timing of the Fed’s next interest rate move and the upcoming election.

The next interest rate move has largely been overshadowed by the presidential election, but it still appears to be a worry among investors. It’s not clear when the Federal Reserve will next raise the short term fed funds rate. They last raised it in December, and there is talk that they may raise it again this December. In the aftermath of the financial crisis, interest rates remain at generational lows, with the Federal Reserve showing little interest in raising rates too quickly, fearing it may inhibit economic growth. We have said this before, but it bears repeating: raising rates from these emergency low levels should be seen as a good thing for the economy and the markets. The economy is improving, albeit at a slow pace. While rising rates can cause short term angst in the markets, stocks have historically performed well in periods of rising interest rates.

We can look back to the most recent period, from 2004 – 2006, where the Fed increased interest rates 17 times. Over that time period stock prices rose nearly 11%. Or the period from 1999-2000, where the Fed raised rates six times, and the markets delivered a 10% return. So, no, rising interest rates do not automatically spell doom for the markets. History suggests otherwise.

Next month, Americans will head to the polls to elect the next president of the United States. While the outcome is unknown, one thing is certain: There will be a steady stream of opinions from pundits and prognosticators about how the election will impact the stock market.

As we explain below, investors would be well‑served to avoid the temptation to make significant changes to a long‑term investment plan based upon these sorts of predictions.

Trying to outguess the market is almost always a losing game. Current market prices offer an up-to-the-minute snapshot of the aggregate expectations of market participants, including expectations about the outcome and impact of elections. While unexpected future events—surprises relative to those expectations—may trigger price changes in the future, the nature of these surprises cannot be known by investors today, so it’s risky trying to invest based on what are (at best) guesses. The same advice holds true when investors try to gain an edge by attempting to predict what will happen to the stock market after a presidential election.

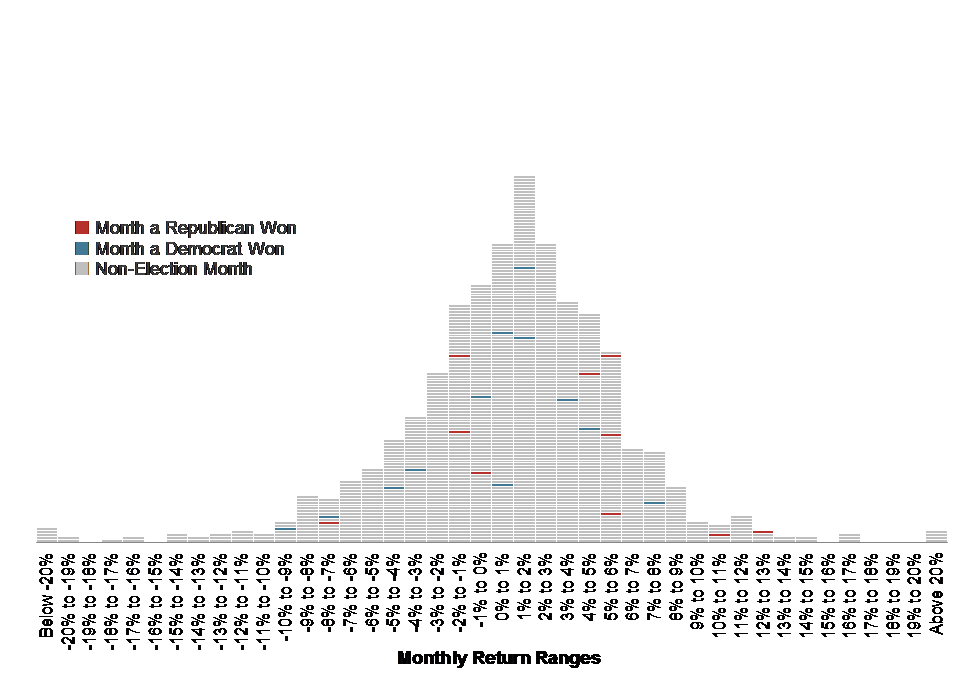

The chart below shows the frequency of monthly returns (expressed in 1% increments) for the S&P 500 Index from January 1926 to June 2016. Each horizontal dash represents one month, and each vertical bar shows the cumulative number of months for which returns were within a given 1% range (e.g., the tallest bar shows all months where returns were between 1% and 2%).

The blue and red horizontal lines represent months during which a presidential election was held. Red corresponds with a resulting win for the Republican Party and blue with a win for the Democratic Party. This graphic illustrates that election month returns were well within the typical range of returns, regardless of which party won the election. Plus, they were both positive and negative for both parties.

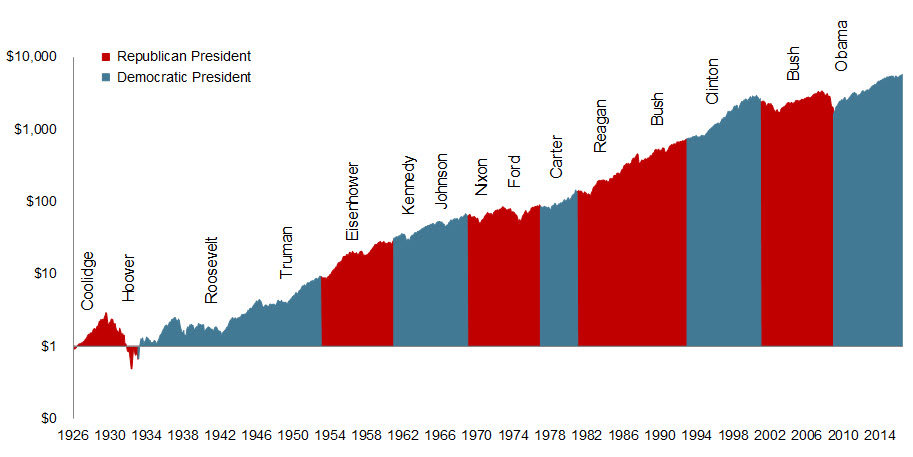

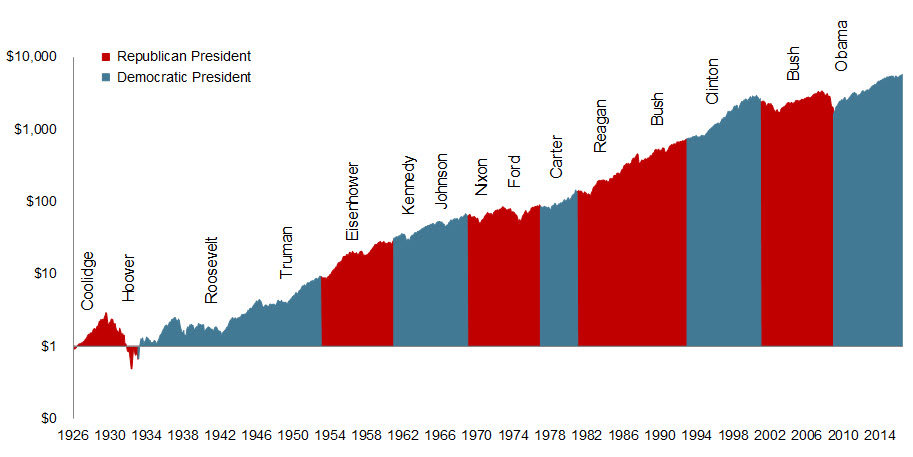

Predictions about presidential elections and the stock market often focus on which party or candidate will be “better for the market” over the long run. The graph below shows the growth of one dollar invested in the S&P 500 Index over nine decades and 15 presidencies (from Coolidge to Obama). This data does not suggest an obvious pattern of long-term stock market performance based upon which party holds the Oval Office. The key takeaway here is that over the long run, the market has provided substantial returns regardless of who controlled the executive branch.

This may seem like common sense but given the level of anxiety and vitriol we have witnessed this election cycle, it does bear repeating that no matter who wins the White House next month, the nation and the world are not going to come to an end. Higher or lower taxes, Obamacare or no Obamacare. The miracle of capitalism is it can survive and thrive in any environment you can throw at it. Some environments are obviously better than others, but either way, the country and the economy will be fine.

So as the holidays beckon, we hope you will take time to be with loved ones and celebrate all you have been blessed with. We only pass this way once, so make the most of it!

Are you looking for life-long financial planning support beyond traditional wealth management? Then Del Monte Group is the right place for you. At DMG, we address a client’s entire lifestyle to help make all goals become a reality–even if they aren’t directly related to money. Our clients are more than just assets and investments. They are human beings with their own stories, and they are our family. So, when you’re in the greater Alamo or Danville, California area our door is always open to assist you in person Call us at 925.736.6410, send an email to Info@APlaceOfPossibility.com, visit APlaceOfPossibility.com/Calendar to get your meeting on the books. We can't wait to help you.