We continue to live through a period in history none of us will ever forget—yet, many would like to. The pandemic has changed our lives in so many ways—from the way we work to the way we shop to the way school is being taught and everything in between. On a personal level, with two young kids in school, I, for one, have been impressed with how they have adapted and rolled with the less than ideal learning set up.

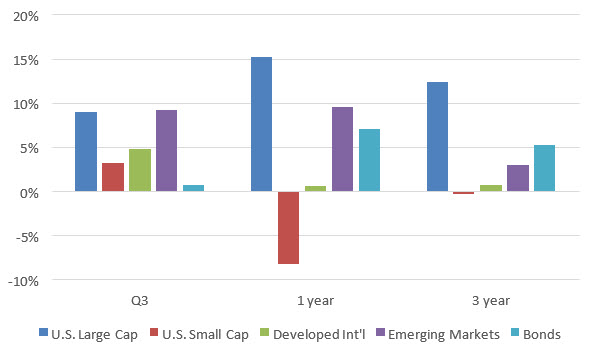

Investors experienced a little volatility in the month of September with stock prices falling nearly 10% before rebounding. However, stocks had a strong third quarter. The S&P 500 finished the quarter up 8% and is now up 4% overall in 2020. Back in March, who would have guessed that the S&P 500 would be hitting new highs this year? U.S. small company stocks were up 4% for the quarter but are still down 10% for the year. The smaller companies have been disproportionately impacted by the pandemic.

International investments are also down for the year but posted positive returns in the third quarter. The EAFE index of developed international stocks gained 4% over the past three months, but they are down about 9% for the year. Emerging market stocks are also down 3% YTD, but had a strong quarter, posting an 8% gain.

Overall, the third quarter delivered a second consecutive quarter of gains erasing all the losses sustained in February and March. Since the end of March, the S&P 500 index has gained 37%—the best two quarter performance since 2009. I can’t believe I just typed that sentence, in 2020 of all years!

The unpredictable year 2020 looks no more predictable going into the fourth quarter of the year. The coronavirus is still very much with us, as is much of the economic dislocation caused by the lockdowns. We are a couple of weeks away from the U.S. elections, and we may or may not get a fiscal stimulus package before the election.

Of course, there are also reasons to be optimistic. We seem to be closing in rapidly on a vaccine. In fact, several vaccines. Additionally, medical professionals have come an incredibly long way in treating the disease, which has significantly lowered the mortality rate of those who contract it. Consumers have shown a propensity to spend as evidenced by the recent retail numbers that came in above pre-pandemic levels. GDP fell by 31% at an annualized rate) in the second quarter but is expected to show significant improvement in the third quarter, with estimated growth to be as high as 34% annualized. We still have a way to go, but we are far from the doom that some economists were predicting.

Lessons COVID Taught Us

These past nine months have offered some invaluable investment lessons. We would be remiss if we didn’t take this opportunity to review what we as investors should have learned—or relearned—since the onset of the great market panic that began in February/March. And that ended when the S&P 500 Index regained its pre-crisis highs in mid-August. The lessons are:

- No amount of study—of economic commentary and market forecasting—ever prepares us for really dramatic events, which always seem to come at us out of deep left field. Therefore, trying to make an investment strategy out of “expert” forecasts always sets investors up to fail. Instead, having a long-term plan, and sticking with that plan through all the fears (and fads) of an investing lifetime, tends to keep us on the straight and narrow and helps us avoid sudden emotional (and often erroneous) decisions.

- The S&P 500 went down 34% in 33 days. None of us have ever seen that precipitous a decline before. While 30% declines are rare, they are not unprecedented. As you can see from this JP Morgan chart, the market has experienced five such events over the past 40 years.

But in those 40 years, the S&P Index has gone from 110 to where it is now, 3,350 (not including dividends). The lesson is that, at least historically, such declines haven’t lasted, and long-term progress has always reasserted itself.

- Almost as suddenly as the market crashed, it completely recovered, passing its February 19 all-time high on August 18. Note that the news concerning the virus and the economy continued to be dreadful, even as the market came all the way back. There are two great sub-lessons here: (1) The speed and trajectory of a market recovery very often mirror the preceding decline’s violence and depth. (2) The equity market most often resumes its advance and may even go into new high ground, considerably before the economic picture clears. If we wait to invest before we see clear favorable economic trends, history tells us that we may have missed a very significant part of the market’s recovery. Accordingly, the investment strategy of “waiting until the dust settles” before investing is a failure. .

The overarching lesson of this year’s swift decline and rapid recovery is, of course, that the market can’t be timed. For long term, goal-focused, equity investors, it is best advised to just ride it out—like you have heard us preach time after time.

“If you mix politics with your investment decisions, you’re making a big mistake.” —Warren Buffett

We’ll close by touching on the highly contentious upcoming election. It’s no secret that emotions run high in election season, and it can be hard to divorce your political convictions from the investment process. But you must. The stock market has done well under both Republicans and Democrats, even adjusted for Congressional control. For more information, I discuss how little the stock market cares about what political party is in power in a brief video, which can be found on Del Monte’s YouTube channel or social media pages.

As we have all year—and as we do every election year—we urge you to stay the course. As always, we’re here to talk any and all of these issues through with you. That’s our job.

As always, we thank you for your confidence and trust. All of us at Del Monte Group hope that you and yours remain healthy and safe. We also hope you can enjoy the upcoming holiday season; pandemic notwithstanding.

Alamo, CA neighbors and beyond it’s time to discover your Place of Possibility™ today. Our goal is to address every aspect of your life, defining a clear and actionable plan that meets your lifestyle needs. So, whether we’re holding your hand or taking more of the reins for you while you do life, you can rest assured that your money is growing and working for you while you enjoy it. Who knew?! Sound like something you’re struggling with or need more of? Get in touch to schedule a free 30-minute consultation, and let’s get started! You can contact us in a few different ways. One, by calling at 925.736.6410, you can send us an email at Info@APlaceOfPossibility.com or jump right into our calendar and select a date and time that works for you. We’re excited to meet with you!