Well, there’s no way to sugar coat it, this market has been relentless in downward selling pressure this month. I’ve been doing this for 33 years now and the sheer number of 500-point declines has been breathtaking. Santa is leaving us a lump of coal this year, that’s for sure.

Everywhere the market looks it finds something it doesn’t like. One day its trade policy, China’s growth rate and tariffs, the next its fears about the economy, then it’s Fed policy, then it’s the Fed actually raising interest rates ¼ percent (which over two days cost about 800 points on the Dow). Add in the oil prices tanking, Trump being Trump, a potential government shutdown…the list goes on and on. Whenever any good news is issued, it is ignored.

A little perspective would be helpful. As of the market close on Thursday, the Dow is down 7.55% YTD and 14.8% from the peak in early October. The S&P 500 is down 7.9% YTD and 17.5% from the October high.

How worried should we be? Nobody likes to go through down markets, so it’s completely understandable to be feeling blue about the current state of the markets. Going back to the early 1900s there’s been an average of one market correction of 10% every year. There’s been a 20% drop once every 3.75 years. That’s almost 120 declines of 10% and 36 declines of 20% over that time. Translation: while painful and scary, these are completely normal. Don’t forget that over this time and despite these declines, the S&P 500 has still averaged 10-11% annually.

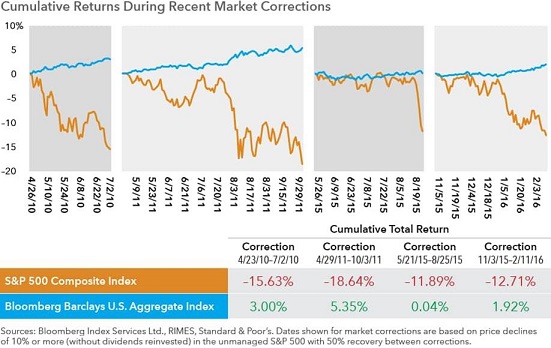

The graph below, showing all the market drops since 2010, was created at the end of last year, so it doesn’t show the drop we had in February of this year, which was a 10%er. I have yet to meet a single person who even remembers that drop, yet it was a substantial one.

Nevertheless, the important point is we’ve had some nasty declines in recent years, but they always fade from our memories and they have zero lasting relevance. This is why this quote is so timely:

“Every past decline looks like an opportunity; every future decline looks like a risk.” – Morgan Housel

We have been working feverishly on your behalf to benefit you during this decline. Whenever possible we have taken tax losses to reduce clients’ tax hits on taxable accounts, and we have been buying more of the asset classes that have been hit hardest this year, namely small caps, emerging markets, international small caps, and international large caps. Should the selling continue in the large US stocks in the days ahead, we will also be buying more there also.

I wish I could tell you when the selling will end, but that would be knowing the unknowable. Heck, it’s hard to tell what all the selling is even about. The Federal Reserve raised interest rates yesterday because they continue to think the economy is fundamentally strong and sound. They have no interest in driving the economy into a recession.

I can tell you that selling like we’ve seen in recent days always ends (even though that might be hard to imagine in this market) and brighter days are ahead. My experience tells me that we are overdue for a bounce back, but who knows when that will be?

There are lots and lots of great opportunities in the markets right now. Everywhere you look there are great prices to be had in stocks. The expected returns in the markets as they are now priced are exceptionally high. This is not to say there won’t be even better deals in the days ahead, but things WILL work out. We will all be fine. What is happening is normal and frequently occurs. Rest easy and try to be patient.

Most of all, Merry Christmas and Happy Holidays!!

Alamo, CA neighbors and beyond it’s time to discover your Place of Possibility™ today. Our goal is to address every aspect of your life, defining a clear and actionable plan that meets your lifestyle needs. So, whether we’re holding your hand or taking more of the reins for you while you do life, you can rest assured that your money is growing and working for you while you enjoy it. Who knew?! Sound like something you’re struggling with or need more of? Get in touch to schedule a free 30-minute consultation, and let’s get started! You can contact us in a few different ways. One, by calling at 925.736.6410, you can send us an email at Info@APlaceOfPossibility.com or jump right into our calendar and select a date and time that works for you. We’re excited to meet with you!