If you’ve been following our blog for long, then you’re surely familiar with the saying, “Don’t put all of your eggs in one basket.” Reason being, if you were to drop that one basket, you risk breaking and losing all of your eggs. Instead, you are infinitely better off placing your precious eggs in multiple baskets, in order to reduce that risk. The same logic applies to investing. Diversification, placing eggs (money) into various baskets (asset classes), is a key tenant of prudent portfolio management. Sadly, far too many investors are unaware of, or ignore this proven strategy at their own risk.

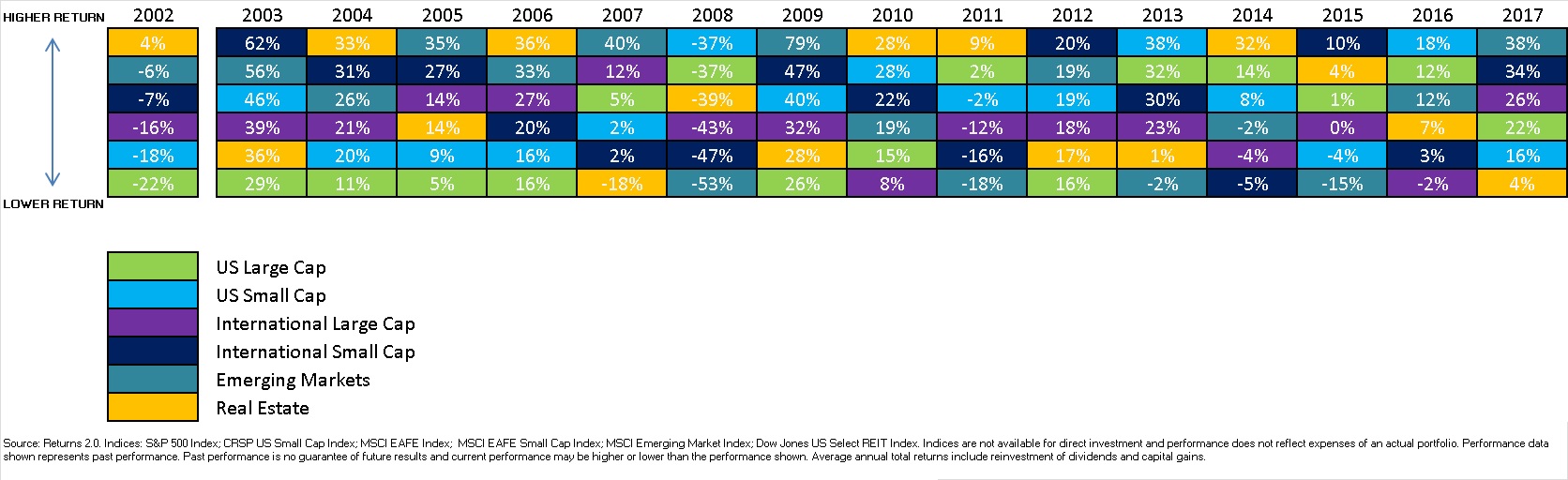

To illustrate the benefits of diversification, take a look at the table below, often referred to as the Periodic Table of Investment Returns (remember the periodic table of elements from high school chemistry?), or the Returns Quilt, given its colorful array of boxes.

The table illustrates annual returns for six equity asset classes—US large and small stocks, international large and small stocks, emerging market stocks, and real estate—from 2003 to 2017. The asset classes are color-coded for easy tacking purposes.

Each column illustrates the returns for a particular year with the best performing asset class on top, and the ranking continues in descending return order, with the worst ranked asset class at the bottom. Do not focus on the return numbers as much as the colors.

Do you recognize any patterns? No? That’s because there aren’t any. There is very little consistency from year-to-year. The “colors” bounce around unpredictably.

Most investors are, or should be, familiar with the investment disclaimer, “past performance is no guarantee of future results.” The table shows why that disclaimer is so essential. When it comes to investment performance, the past has little to no predictive value. Some outperforming asset classes continued to outperform, while others found themselves underperforming in subsequent years. There’s just no way to use past performance to guess what next year’s performance will be (unless you can operate a crystal ball), and this is something that goes against human nature because our brains are wired to look for patterns in order to figure out what we should do next.

Using the return data above, we set out to determine which investment strategy delivered the best results over the past 15 years (2003-2017). We looked at three different strategies:

Strategy One

Buy last year’s winner. This strategy invested in the previous year’s top performer on January 1st of the following year. Beginning in 2003, this strategy was 100% invested in Real Estate (2002’s best-performing asset class). The next year it was 100% invested in International Small Cap (2003’s “winner”), and so on.

Strategy Two

Buy last year’s loser. This counter-intuitive strategy bought the worst performing asset class from the previous year. In 2003, the strategy was 100% invested in the S&P 500 (2002’s worst-performing asset class). It remained invested in the S&P 500 through 2007 before being replaced by 2007’s “loser,” Real Estate.

Strategy Three

Invest an equal amount in each of the six asset classes, rebalanced annually on January 1.

Any guesses as to which strategy produced the best results after 15 years?

I’ll wait…

OK, have a guess?

If you guessed the equally-weighted diversified portfolio, you are correct! Probably not a surprise given this article is entitled, “Diversification!” Have a look at out the chart below, which shows the outcome of each strategy.

GROWTH OF WEALTH

(12/31/2002 – 12/31/2017)

The blue line is a hypothetical investment of $100,000 at the beginning of 2003 into Strategy One, buying last year’s winner. The yellow line shows Strategy Two, buying last year’s loser, and the green line is Strategy Three, buying an equal amount of each asset class.

The results are fascinating! By simply admitting we don’t know what the future will bring and spreading the initial investment over all six asset classes, investors would have ended up with $523,132 after 15 years. This is $42,700 (9%) more than the strategy of chasing the lowest returning asset class and $136,319 (35%) more than the strategy chasing the highest returning asset class.

It is also worth noting that Strategy One was less volatile than the other two strategies. The lows were not as low and the highs were the highest of all three. In fact it never underperformed the other two strategies!

The takeaways for investors are threefold: (1) Chasing past returns never pays off ; (2) buy low, sell high; and (3) diversify, diversify, diversify!

The hard part, naturally, is implementing what we know works in the real world. We are constantly pushed and pulled by our emotions, hunches, political persuasions, and the incessant financial media. Preventing you from falling into these traps is one reason why a good financial advisor can be worth his or her weight in gold, for many people.

Please contact our team for more information on how to better diversify your portfolio.

Are you looking for life-long financial planning support beyond traditional wealth management? Then Del Monte Group is the right place for you. At DMG, we address a client’s entire lifestyle to help make all goals become a reality–even if they aren’t directly related to money. Our clients are more than just assets and investments. They are human beings with their own stories, and they are our family. So, when you’re in the greater Alamo or Danville, California area our door is always open to assist you in person Call us at 925.736.6410, send an email to Info@APlaceOfPossibility.com, visit APlaceOfPossibility.com/Calendar to get your meeting on the books. We can't wait to help you.