By Richard Del Monte, JD, CFP®

KEY TAKEAWAYS

- After posting double-digit losses in 2022, stocks soared and bonds rebounded last year.

- Gains in the tech sector helped growth stocks outperform value stocks in the US, but the value premium was positive outside the US.

- Economic resilience in the US and elsewhere is helping boost the global outlook, but 2023 showed why planning for uncertainty is prudent.

It was a year that defied expectations by many accounts. A number of forecasts predicted that the US economy would enter a recession in 2023 as the Federal Reserve raised interest rates to fight high inflation. But the economy remained resilient, inflation eased, and the Fed declined to lift rates later in the year. US stocks rose in 2023, despite some setbacks along the way.1 Many economists who called for a recession have since walked back their predictions. This underscored that guessing where markets may be headed is not a reliable way to invest.

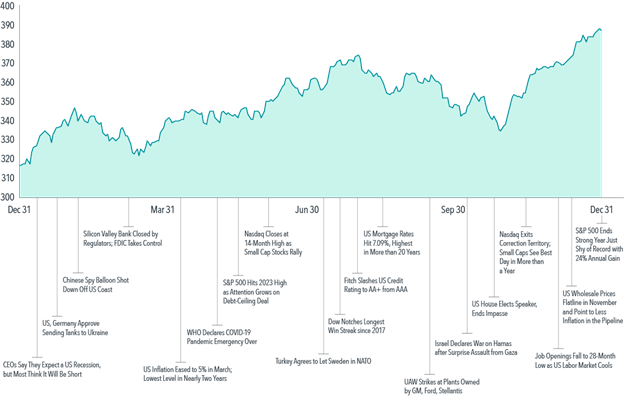

A year that many speculated would be lackluster for US stocks saw the S&P 500 post gains of 26.3% on a total-return basis, extending a bull-market rally that began in 2022.2 Global stock markets also bounced back after posting their worst year since the financial crisis. Equities, as measured by the MSCI All Country World Index, rose 22.2% even as geopolitical tensions increased, with war continuing in Ukraine and hostilities erupting in the Middle East (see Exhibit 1).3 Developed international stocks, as represented by the MSCI World ex USA Index, added 17.9%, while emerging markets notched smaller gains, with the MSCI Emerging Markets Index up only 9.8%.4

EXHIBIT 1

Moving on Up

MSCI All Country World Index (net div.) in 2023

Past performance is not a guarantee of future results.

US inflation continued to retreat from June 2022’s four-decade high of 9.1%, with the 12-month rise in consumer prices falling to 3.1% in November, a lower level than many had expected.5 After raising rates three times in the year’s first half, the Fed made only one additional increase later in 2023. Policymakers indicated they will likely continue to hold interest rates steady, despite inflation remaining above its 2% target. Against this backdrop, even while the broad economy remained strong, some sectors, such as real estate and finance, lagged.6 Higher interest rates dampened home sales and new development activity. In the financial sector, the rapid rate increases in early 2023 left some regional lenders, such as Silicon Valley Bank, in precarious financial positions, with the value of their long-term Treasury bonds sinking. Many nervous depositors withdrew their cash, resulting in three of the four largest bank failures on record (after Washington Mutual in 2008).

In Washington, politicians debated the US debt ceiling and government funding. The president and Congress eventually agreed to raise the debt limit in June, avoiding a US default. Despite the two-year spending deal, Fitch downgraded its credit rating on US debt, citing the country’s rising fiscal deficits and “the erosion of governance” that has led to multiple clashes over the debt limit in recent decades. However, stock and bond markets seemed to take the news in stride. While debt ceiling debates and credit rating downgrades often dominate headlines, implications for investors can be muted. The US government temporarily averted a shutdown after the House and Senate passed short-term funding deals in September and again in November. The threat of a shutdown still looms if a longer-term funding resolution isn’t reached in early 2024, but, as for stock returns, history shows the result of a shutdown isn’t necessarily poor equities performance.

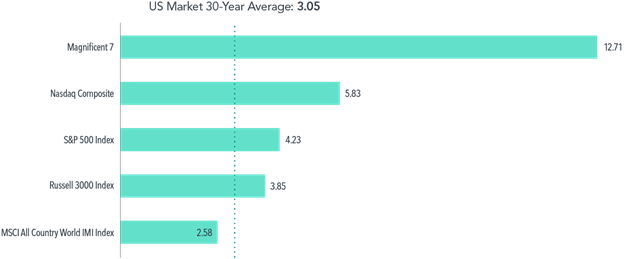

Big Boost from Big Tech

Among the strongest performers in 2023 were technology stocks, recovering after a poor showing in 2022. The tech-heavy Nasdaq rose 44.6%.7 Much of the stock market’s gains can be attributed to just a handful of companies, recently dubbed the Magnificent 7.8 They were led by NVIDIA amid strong sales of its computer chips, as interest in artificial intelligence built. However, valuations for those seven stocks remain high, with an aggregate price-to-book (P/B) ratio of 12.71. This helped push up the Nasdaq’s P/B ratio to 5.83. Some other prominent indices have substantially lower valuations. For example, the MSCI All Country World IMI Index’s P/B ratio is less than half that of the Nasdaq’s (see Exhibit 2). While high valuations may concern equity investors, they can result from a subset of companies. Investors should be careful not to paint all stocks with the same brush.

EXHIBIT 2

Magnificently Priced

Aggregate price-to-book ratios as of December 31, 2023*

Magnificent 7 outperformance might be difficult to sustain; past gains don’t guarantee future ones. Rather than seeking additional exposure to these mega cap stocks, investors may be better off ensuring their portfolios are broadly diversified, positioned to capture the returns of whatever companies may rise to the top in the future.

The gains of the growth-oriented US tech sector helped growth stocks outperform value stocks on a global basis and in the US, despite a strong start and finish to the year for value. The MSCI All Country World Growth Index rose 33.2% vs. a 11.8% increase for the MSCI All Country World Value Index. Without the help from US tech stocks, the MSCI All Country World ex USA Growth Index rose 14.0% vs. a 17.3% increase for the MSCI All Country World ex USA Value Index, resulting in a positive value premium outside the US. Small cap companies lagged behind large cap stocks globally: The MSCI All Country World Small Cap Index returned 16.8% vs. 22.2% for the larger-cap MSCI All Country World Index. Historically, small caps and value stocks have outperformed large caps and growth stocks, respectively.9

A trend of outperformance has also been recorded over time in the stocks of companies with high profitability vs. the stocks of companies with low profitability. Last year, that was the case in both developed and emerging markets. The Fama/French Developed High Profitability Index rose 27.9% for 2023, while its low-profitability counterpart rose 18.0%. The Fama/French Emerging Markets High Profitability Index rose 16.6% vs. 9.0% for its low-profitability counterpart.

In the bond market, US Treasuries rebounded after posting their worst annual return in decades in 2022, with the Bloomberg US Treasury Bond Index gaining 4.1% vs. the previous year’s 12.5% decline.10 But it was not a smooth ride for investors. Despite rising bond prices generally, yields (which fall when prices rise) were higher than they have been for most of the past decade. The 10-year Treasury yield nearly touched 5% in October for the first time since 2007, before pulling back below 4% by year-end.11 For the entire year, the 10-year yield was lower than that of three-month bills, keeping the yield curve inverted. While many investors see yield curve inversion as a foreboding signal of a recession or stock market downturn, data from the US and other major economies show yield curve inversions have not historically predicted stock downturns consistently.12 And no US recession was declared in 2023.

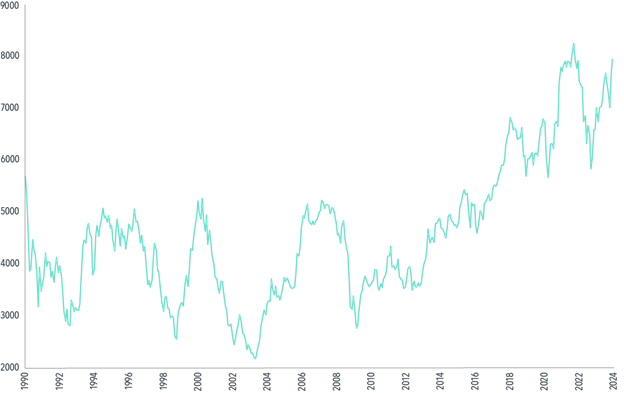

Japan Makes a Comeback

After decades of lagging behind, Japan has lately been a bright spot in global markets. From 1990 to 2022, Japan saw its share of the global market cap decline from 40% to 6%.13 But since September 2022, Japan has posted a return of 28.1%, with stocks there nearing an all-time high (see Exhibit 3).

EXHIBIT 3

Land of the Rising Stocks

MSCI Japan Index (net div.) since 1990

Past performance is not a guarantee of future results.

The turnaround in Japan is more evidence that regional and country returns will vary from year to year. An up year for US or Japanese stocks might be followed by a down year, showing the benefits of remaining globally diversified. The randomness of global stock returns makes it difficult to figure out which markets are likely to be outperformers. In the past 20 years, annual returns in 22 developed markets varied widely from year to year. Holding equities from markets around the world—as opposed to those of a few countries or just one—positions investors to potentially capture higher returns where they appear, and outperformance in one market can help offset lower returns elsewhere.

What’s in Store for ’24?

Economic resilience in the US and elsewhere is helping boost the global outlook for 2024, but as investors learned last year, the only thing certain is that there will be plenty of uncertainties. Many variables are in play for markets this year, from wars in Ukraine and the Middle East to questions around interest rates. Investors are also likely to be closely following the upcoming presidential election in the US. But it’s worth noting that the political party that wins the White House is just one of many factors investors consider when pricing assets, and stocks have generally trended upward regardless of which party holds the presidency. This may be reassuring when one considers the difficulty, or perhaps futility, of trying to guess what is going to happen in 2024—or any year. That’s why we have often recommended that investors plan for what might happen rather than predict what will. Last year was a vivid example of why we offer such advice.