By: Leo Bojorquez, ChFC®

Just like that, another year is in the books – and good riddance! Investing in 2022 was not for the faint-hearted, to be sure. We started with a continuance of the 2021 cryptocurrency mania, and just like the California Gold Rush; while a few made a killing and got out, far too many got sucked into the hype and lost big. It’s the age-old story of get rich quick that always finds a new way to catch people.

In the first quarter of 2022 we faced the Ukraine and Russian conflict, which seemed to dominate much of the geopolitical news. With the invasion of Ukraine, continuing supply chain shortages that started during the darkest days of the COVID-19 pandemic, and rapidly rising inflation; the focus quickly shifted to and remained on the Federal Reserve for the entire year.

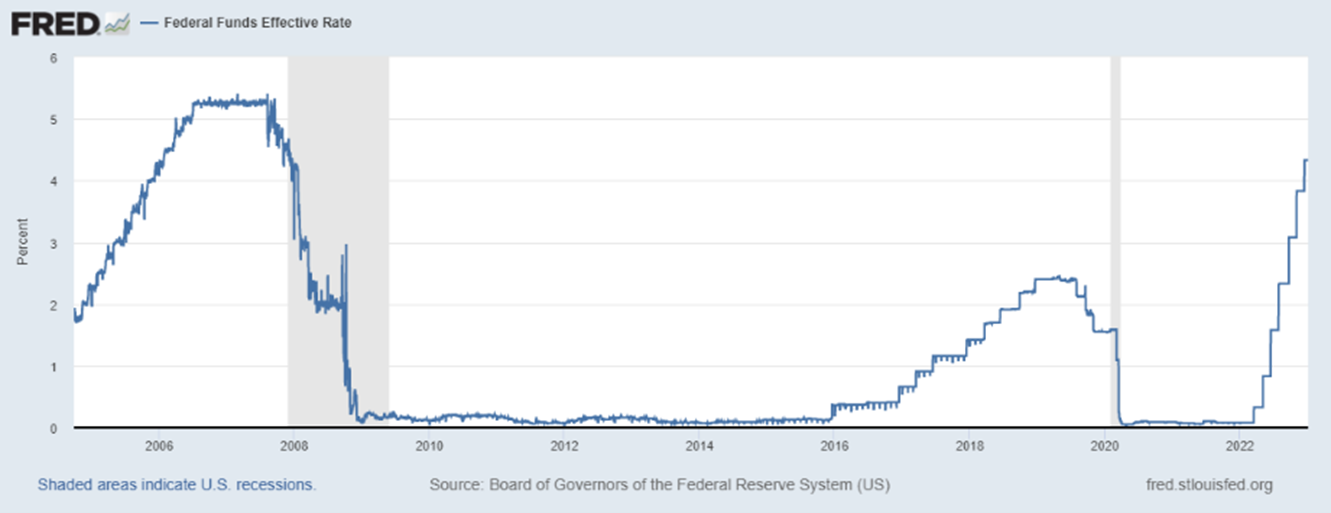

As prices rose across the board, the Fed countered with a breathtaking series of interest rate hikes, and the stock and bond markets responded in kind. The S&P 500 ended the year down 18%, while the bond market also experienced the worst year in history, closing down 13% on the year. Wow! This was to be expected though, because bonds and interest rates have an inverse relationship – whenever rates rise, prices fall, and vice versa. As a result of the Fed’s yearlong series of seven rate hikes, the Federal Funds Rate ended at 4.33% for 2022, and investors finally started seeing some decent returns on their fixed income assets, which is something we haven’t seen in almost two decades. The higher yields on cash, T-bills and savings accounts allowed investors to hedge their portfolios with safer assets. The chart below shows the changes in the Federal Funds Effective Rate since 2005. You can see that we are near the highest rates in the last 20 years, but we haven’t set any records.

The Fed’s rate hikes have helped reduce inflation during the second half of the year, but the economy has stubbornly remained stronger than most anticipated. This is best evidenced by the strength in the labor market. After a year of rising interest rates, December showed 233,000 more non-farm jobs were created. This has fueled renewed hopes for a soft landing in the economy this year, instead of a recession.[1]

The one sector of the stock market that performed well in 2022 was… wait for it… ENERGY. Not a shocker—natural gas and gasoline prices rose, and subsequently energy stocks rose by roughly 40%. Utilities also increased slightly, .5%, in the last 12 months. In June, gasoline prices rose to $7.00 per gallon in San Francisco, CA[2], but have since fallen back to the $4.00 range.

The residential real estate market was on a tear up until June and now prices are slowly starting to decrease as a result of steep increases on mortgage rates. The average 30-year fixed mortgage is roughly 6.7%, compared to less than 3% a year ago. This put a hamper on demand and sales dropped by 35.4% in November from last year. No surprise there.

Well, it can’t all be bad, can it? No, there are always bright areas and glimmers of hope. For starters, housing prices may drop even lower and provide opportunities for beleaguered homebuyers who got outbid by as much as hundreds of thousands of dollars on home after home over the last several years. Now they can buy in peace. Also, yields on cash and treasuries are providing decent returns, but don’t expect to get them from your local bank! Covid and other variants are no longer at the forefront of American news. Gas prices are down. There are two jobs for every one worker. The Fed has remained persistent in its mandate, regardless of the outcome, which instills confidence in the capital markets. Finally, Real GDP rose to 3.2% in the third quarter.

The market will recover, they always have. Unfortunately, we don’t have our crystal ball to tell us when exactly that will happen. What we do have is a hundred years of historical data so for now, remain true to your fundamentals, invest long-term, and remain resilient.

Sources:

[1] Federal Funds Effective Rate (DFF) | FRED | St. Louis Fed (stlouisfed.org)

[2] Bay Area Gas Prices Continue Steady Climb, Closing in on $7 a Gallon – NBC Bay Area

How Do Current Mortgage Rates Compare to Average Historical Mortgage Rates? | The Ascent (fool.com)

US Home Sales Fell in November, the 10th Consecutive Month (usnews.com)