The markets have grown increasingly volatile the last several weeks and over the last couple of days they have taken quite a licking. As of this writing, the Dow and S&P 500 index are down around 4% since the all-time high reached at the end of May. The last two days have seen a slide of about 500 points on the Dow, as a result of comments made by Federal Reserve Chairman Ben Bernanke. World stock and bond markets have naturally followed the lead of the U.S. markets.

So what cataclysmic comments did old Ben make? Essentially, he said that Fed was going to start tapering off its program of buying $85 billion a month in commercial housing market bonds toward the end of the year, and stop it completely in 2014. This bond buying has helped to hold longer-term interest rates down, helping millions of homeowners to refinance their mortgages at historic low rates. The bond buying program is also designed to help stimulate the overall economy and help it recover from the so-called Great Recession of 2008-09.

The markets’ reactions to the Bernanke announcement are very curious. The Fed’s actions over the last five years have basically been an effort to prop up the U.S. economy until it could stand on its own two feet. To us, it’s great news that the Fed feels comfortable stopping their bond-buying program.

Imagine that your mom has been on life support in the hospital for the past several months. You’ve been maintaining a vigil at the hospital the entire time, hoping she will get better and eventually be able to go home. Yesterday, the doctors came in and told you that her condition has improved to the point that they are now comfortable taking her off life support and having her breathe on her own. Wouldn't you be overjoyed at that news?

But the stock market is basically saying that it’s upset the Fed’s life support is being withdrawn, because it is causing interest rates to rise. There is nothing inherently wrong with interest rates being higher. It’s actually a return to normality. It’s how things are supposed to be when you have a healthy economy.

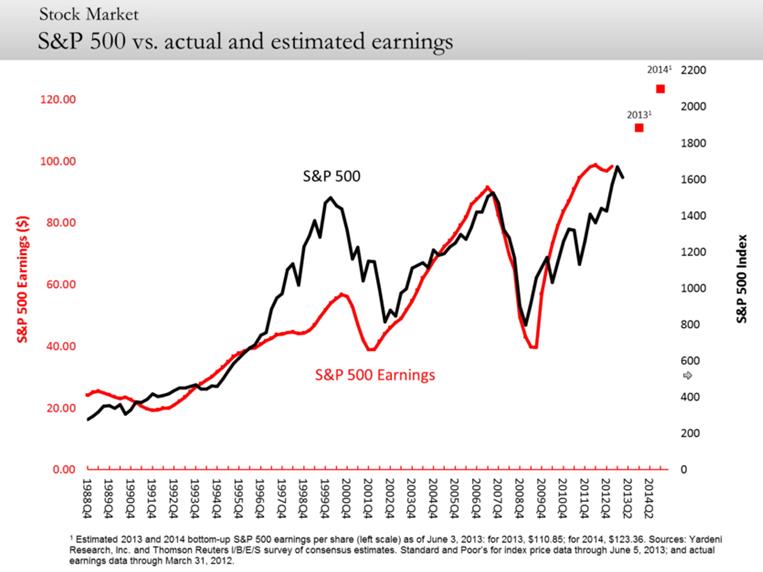

We loathe making predictions about the future of the markets. However, one thing we do know for sure is that over more meaningful periods than a day, a week, or a few weeks, stock prices do closely track the growth in corporate profits. All the other factors that influence stock prices over the short term pale in comparison, and eventually fade away in to obscurity. That means things the markets focus almost compulsively on like interest rates, Fed policy, politics, North Korea, Iran, 9/11, Greece, the Fiscal Cliff, and Y2K do not matter over the long run. They merely give us short-term agita and not much more. Just take a look at the graph below to see what I mean:

Checkmate, right? End of discussion as far as we are concerned. Tell me what corporate profits are doing and I’ll tell you what the stock markets are doing. A few points we hope you take away from this market update:

- The economy is clearly getting healthier. Almost all the recent economic reports validate this point of view. A rising tide raises all boats, and we expect that a growing economy will equate to better stock market performance after the initial shocks of zero interest rates wear off.

- Higher interest rates are not fatal to the economy. To the contrary, a gradual rise in rates is a very positive sign that the patient is able to leave the hospital and return to normal life. And who will object to being able to earn more than 0.0001% on their bank savings and money market accounts?

- Stocks were ready for a pause. Market corrections are a normal and healthy occurrence. We should be worried if we didn’t have them once in a while.

- Markets do not just go up in tandem. This year, many markets that we invest in have been having a tough time. Foreign stocks, emerging markets, bonds, precious metals and commodities have all been having a rough go this year. This is normal and not a reason to panic. We take advantage of these opportunities for you by buying more of these asset classes when the price drops exceed certain thresholds, just like we did for clients during the Great Recession. It works. Market drops are actually our friends when looked at from a longer-term perspective.

As always, feel free to call us if you want to discuss any concerns you have. We love to talk to you!

Alamo, CA neighbors and beyond it’s time to discover your Place of Possibility™ today. Our goal is to address every aspect of your life, defining a clear and actionable plan that meets your lifestyle needs. So, whether we’re holding your hand or taking more of the reins for you while you do life, you can rest assured that your money is growing and working for you while you enjoy it. Who knew?! Sound like something you’re struggling with or need more of? Get in touch to schedule a free 30-minute consultation, and let’s get started! You can contact us in a few different ways. One, by calling at 925.736.6410, you can send us an email at Info@APlaceOfPossibility.com or jump right into our calendar and select a date and time that works for you. We’re excited to meet with you!