Maybe that adage about things turning on a dime should be adjusted for inflation along with everything else these days. Because, at least where the market is concerned, it seems every quarter can turn on you.

As we reported last July, there had been plenty of news that could have dampened year-to-date returns at the time. And yet, most disciplined investors had instead been richly rewarded for sticking with their appropriate investment allocations while most markets fueled “surprisingly strong growth.”

In many respects, market conditions haven’t changed all that much since then. We’re still grappling with economic concerns over interest rates, inflation, and recessionary conditions. U.S. government showdowns continue to loom large, as does an array of ongoing global threats. The price of oil is still problematic. Union unrest remains unsettled.

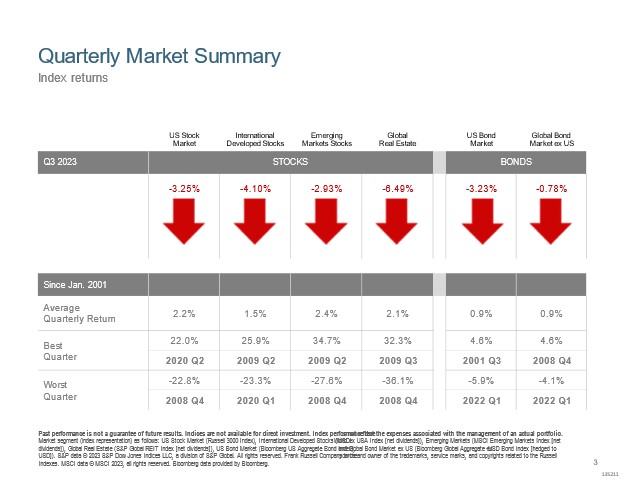

The chart below shows last quarter’s returns for various asset classes. The US equity market posted negative returns for the quarter and outperformed non-US developed markets, but underperformed emerging markets. In English, this means the little guys beat us! Value underperformed growth within large caps and outperformed within small caps. Small caps underperformed large caps, bucking the historical norm. REIT indices underperformed equity market indices. This makes sense as we expect real estate to suffer more during high-interest rate environments.

Comparing recent results to the growth spurt in preceding quarters this year, analysts have been describing current market conditions with words like “blunting,” “sputters,” “retrenchment,” “run out of steam,” and “sideways performance.” Why? As usual, the media needs a bloody story to tell, and these red arrows are awfully compelling, aren’t they?

Just like in life, what you focus on with your investments becomes your world. If you focus only on quarter-to-quarter gains and losses, you might end up feeling a bit like a plastic bag floating in the wind. While the media’s focus is always short-term, the short-term movements of the markets over periods like a quarter or even a year are best treated like the meaningless white noise they really are.

As of this writing, the Dow Jones Industrials are in the negative for the current year to date, while the S&P 500 and NASDAQ are still solidly in the black. Trying to discern any actionable takeaway from these facts would be the height of folly. Different market indices should perform differently. As such, nothing is “wrong” and nothing needs to be “fixed.”

The same goes for small caps, international, and emerging markets stocks, all of which are also underperforming this year. Over the longer term, all the short-term zigging and zagging evens out and the truth comes out.

Want proof? Look at this chart showing the short-term ups and downs of the US stock market over the last 30 years, as indicated by the up and down bars. Then look at the blue horizontal line, which indicates the average annual return over that same time. It is an amazingly consistent 11% per year! So try to relax and zoom all the way out – the picture is clearer from here!

If you are having concerns about your portfolio, we welcome your call and would very much enjoy speaking with you. So pick up the phone and give us a call!